Awards

A top-ranking platform

Awards

A top-ranking platform

At a glance

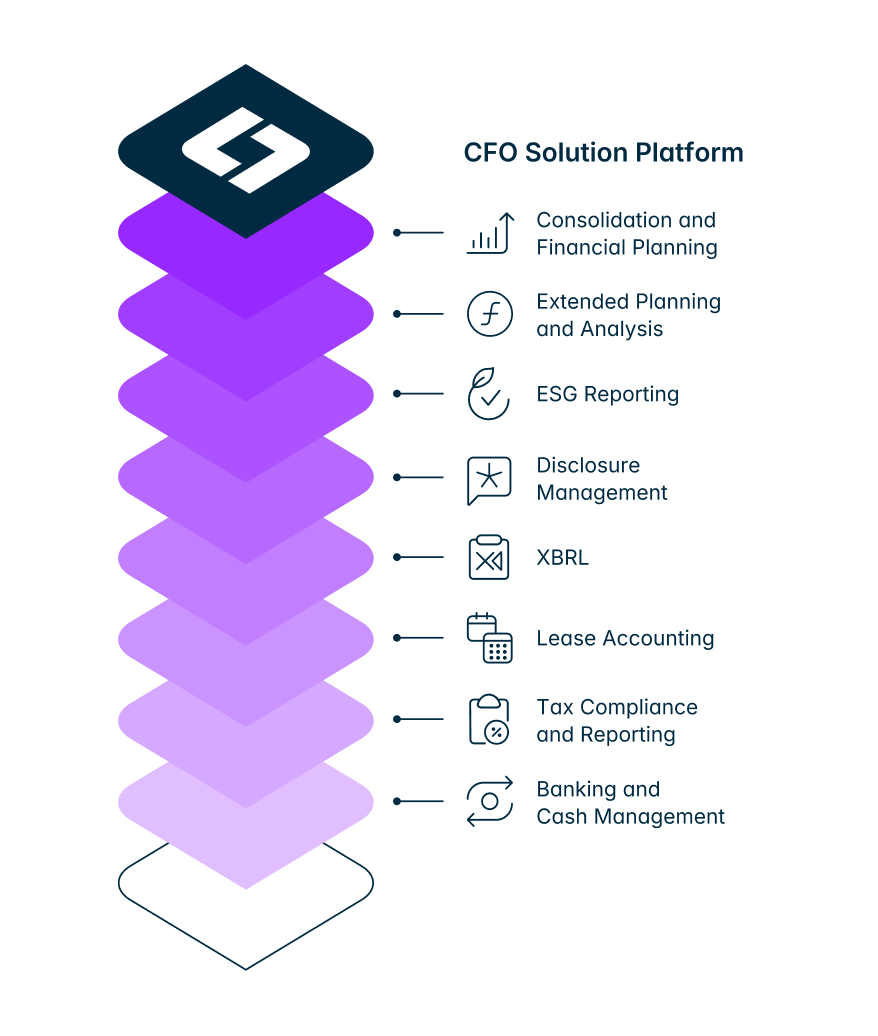

Empower your organization with a CFO Solution Platform that centralizes all financial data, insights, and workflows for seamless integration and enhanced decision-making. Transform your financial management with enterprise-grade solutions tailored to your needs.

Centralized financial management

Unify financial data for improved decision making and strategic planning across the business.

Enhanced workflow efficiency

Seamlessly integrate and transition between each job-to-be-done, optimizing operational efficiency.

Improved compliance and transparency

Easily ensure visibility and compliance with real-time reporting and analysis tools.

Scalable organisational growth

Leverage a comprehensive set of solutions designed to drive financial excellence and long-term success.

ENTERPRISE-GRADE SOLUTIONS

reduction in time required for financial statements

traceable data

users confirm outstanding usability

data points aggregated and reported for CSRD

Featured