When investors make an acquisition, both investors and companies face significant challenges. This is precisely the time when a transparent presentation of finances is important for a successful corporate management.

In this article, we will share the key success factors for achieving maximum financial transparency with you.

What is private equity?

Private equity means that private equity companies (short: PE companies) enter into an equity investment in other companies.

For these companies, this results in several advantages, such as:

- a better access to capital, as well as

- investor support to increase the value of the companies.

The latter is achieved, for example, through specialist know-how, access to networks, or integration of further portfolio companies in larger corporate groups, etc.

A distinction can be made between different forms of private equity, depending on the stage of life of the companies. This includes, for example:

- The venture capital for startups

- Growth capital for expanding companies

- Buy-out financing

The goal of the acquisition is to achieve an increase in value (or value creation) in the portfolio companies within the holding period in order to benefit from a profit on the subsequent sale. The challenges that arise for investors and entrepreneurs in the process can be easily mastered with the help of software.

How can transparent finances be created?

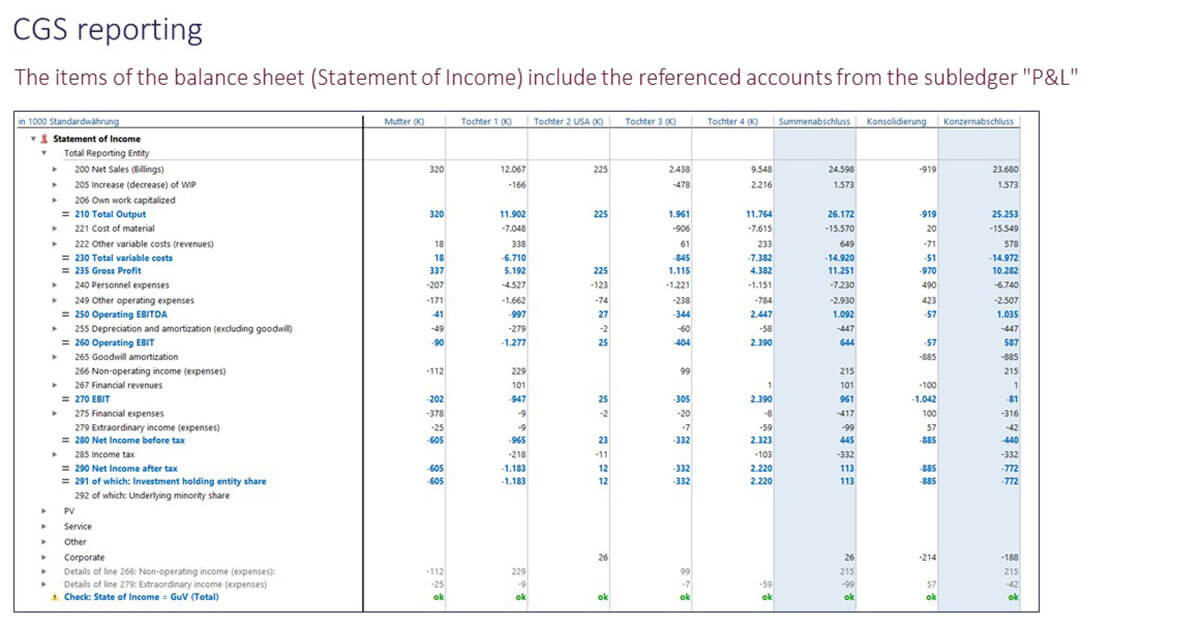

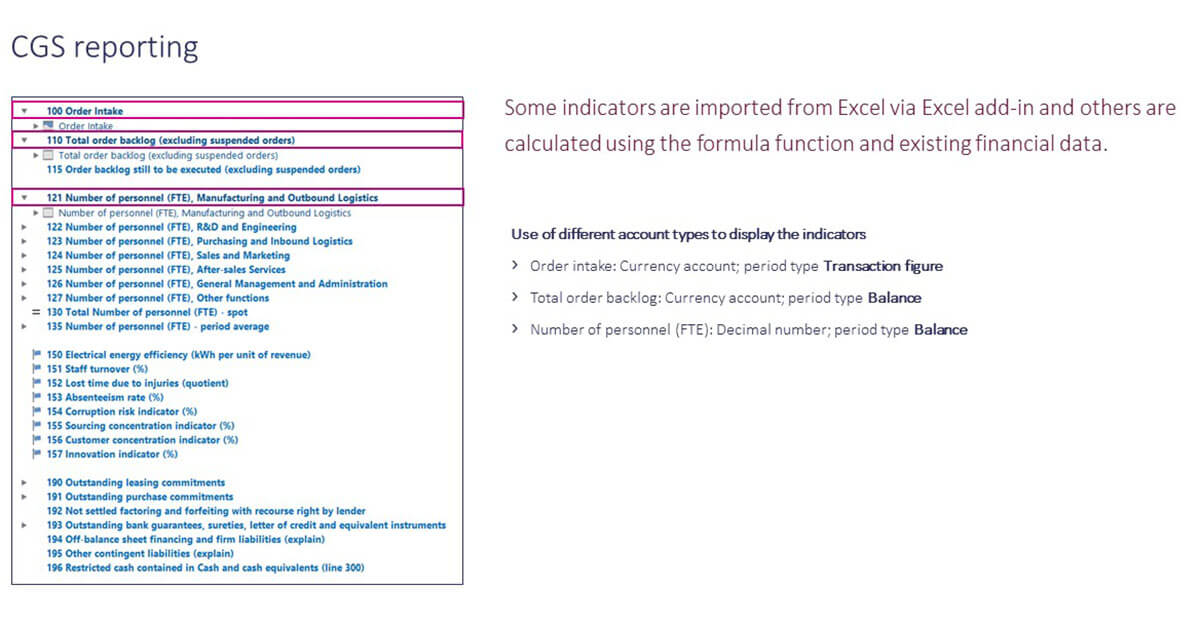

With the help of Lucanet's FPM software and Ebner Stolz's (EBS) expertise in private equity, a large number of successful projects have already been realized. In particular, the following success factors were identified for the successful "onboarding" of the new portfolio companies into the reporting process.

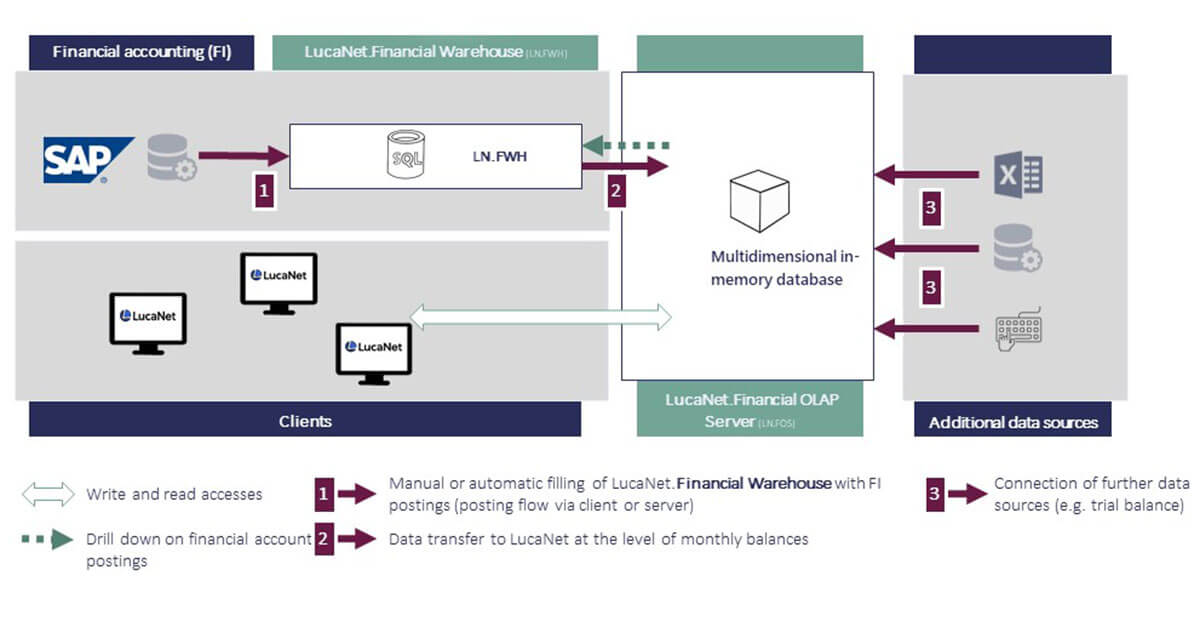

1. Connection to financial acconting

A first and important decision in the context of the introduction of Lucanet software is to weigh up between importing data via totals and balances lists from Excel or setting up a direct interface to the ERP upstream systems.