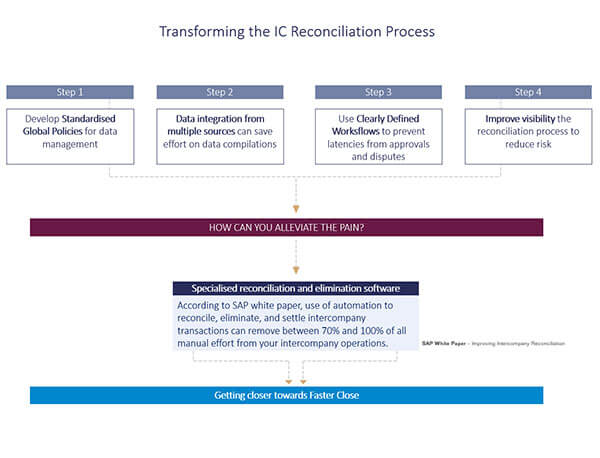

Step 1: Develop standardised global policies

Companies spend an enormous amount of time agreeing on a wide variety of reporting practices being used. If the parent company categorises and tags its transactions in one way and the subsidiaries do it differently, the result will be another data mess that your accounting teams have to deal with. Errors in your financial statements are almost inevitable.

Formalising clearly defined governance and policies to subsequently automate the agreed rules eliminates the need for counter parties having to book and correct intercompany transactions. Having a single method for collecting and distributing intercompany transactional data eliminates any issues over currency values, transaction amounts, and tax implications.

The latest technologies take this a step further by using matching rules to perform intercompany matching based on tolerance levels and identify exceptions automatically. It enables accounting teams to focus on discrepancies without having to certify each account manually, and instead see summaries of differences between entities and drill into the details.

Step 2: Data integration from multiple sources

The research study ‘The Future of Financial Reporting (FSN, 2018)’ highlights significant frustration among finance teams about the problems of extracting data from the source systems. A quarter of respondents to its survey complained that they spend too much time collecting data from multiple sources.

Using finance software that is compatible with all sources of data removes the need to convert your data into a specific format before it is imported. Live integration combined with comprehensive matching capabilities gives you real peace of mind that your intercompany reconciliations are thorough, accurate and on time.

Step 3: Clearly defined workflow

Going back and forth on email with disputes around the reasons behind intercompany discrepancies can often become a high burden on the finance teams. On the other hand, structured workflow ensures that all steps of intercompany reconciliation are completed in a logical order, subject to the required approvals and controls.

Workflow and controls enable organizations to manage disputes using approval procedures, monitoring, and management of resolution all the way through to correction, including routing to the correct staff to decide which legal entity is liable.

Step 4: Improved visibility

Despite a growing complexity of business, traditional approaches to intercompany accounting do little to remove risk from the procedure and provide limited if any visibility upon the status of intercompany reconciliations.

Technology-enabled solutions offer the capability to monitor real time the progress of intercompany reconciliations at any point during the month. Customisable analytics and dashboard capabilities provide visibility to authorised users to track status and progress by selected criteria, for example company, region or close milestones.

It’s clear that companies could save time if their reporting units adopted a peer-to-peer reconciliation method to communicate and resolve differences directly with one another, thereby moving the responsibility for getting things right from central finance team to the reporting units themselves.

Although this seems the obvious way forward, research shows that organisations find such transformation quite challenging and complex, resulting in only 4% of companies achieving the leading maturity level of the IC reconciliation process (Deloitte Development LLC 2017).

Nonetheless, developing companies should note that by applying technology for intercompany reconciliation, you can make radical changes with little effort and potentially achieve significant gains in efficiency. These gains aren’t all financial in nature and can include easing the burden on the central finance function and transforming its role into that of supervisor rather than executor of the IC reconciliation process.

We have summarised how a professional CPM software can help you to optimise intercompany reconciliation. Take a look at our solution page:

Intercompany reconciliation software