In today's dynamic world of business, traditional, isolated methods of financial planning are often outdated and inadequate. In most cases, the monthly business evaluation alone can no longer reliably reflect the financial health and stability of a company. This is where integrated financial planning comes in, enabling precise forecasting and management of a company's financial future.

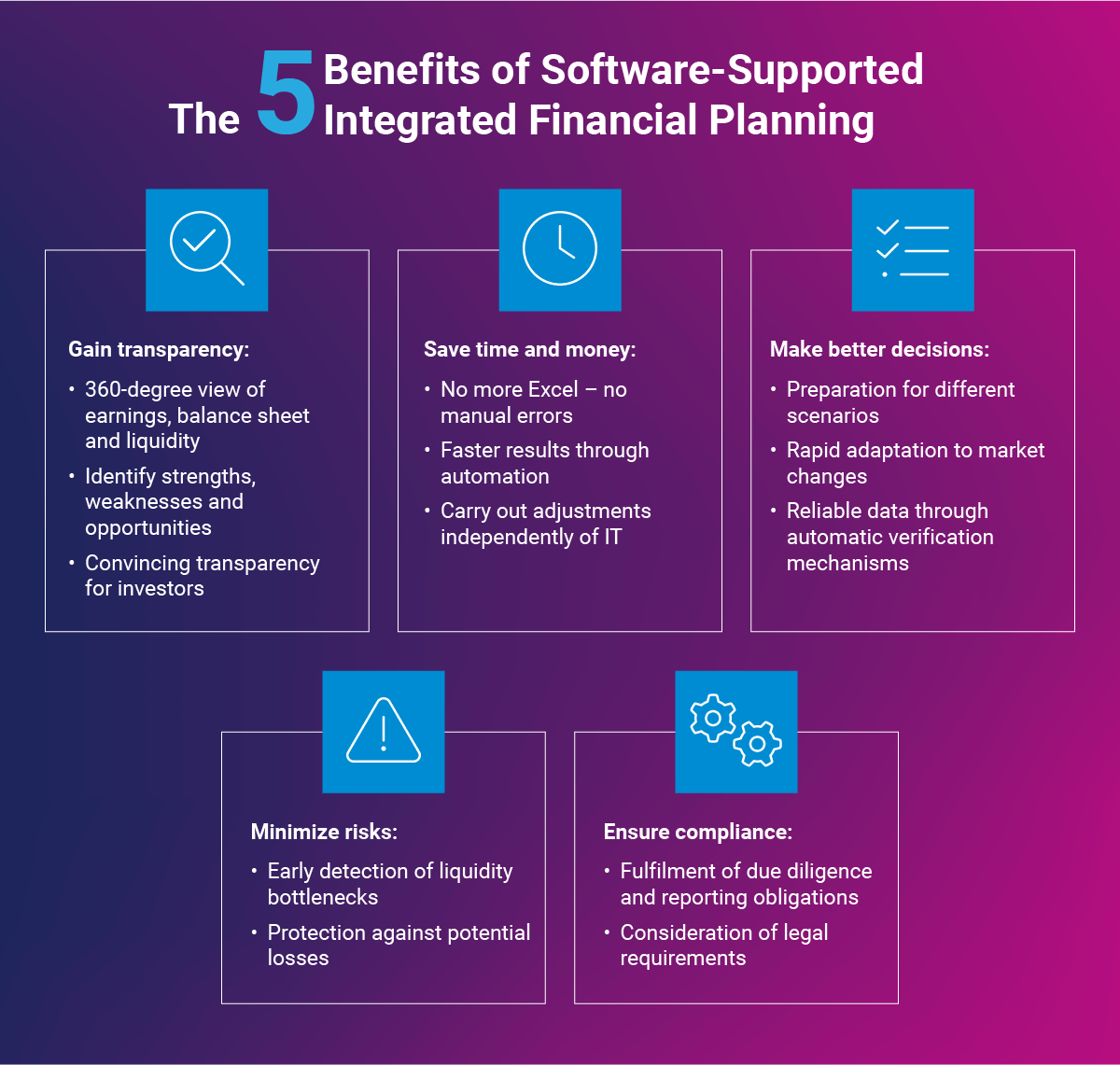

In this article, you'll learn what the top five benefits of software-based integrated financial planning are and how it can help you actively shape your company's financial position, rather than just responding to challenges.

What is integrated financial planning?

In many companies, especially small and medium-sized enterprises, strategic management and financial planning are still carried out as separate activities. This means that the income statement, also known as the profit and loss statement (P&L), is often considered independently. In such cases, typically only a one-year earnings plan is prepared, and if a liquidity forecast is created, it is also done in isolation. Balance sheet planning is also only done in a rudimentary manner.

Integrated financial planning is a different approach. Essentially, it means that the individual elements of the plan, such as the profit and loss account (P&L), balance sheet, and liquidity account, are not considered as isolated elements but instead are contained in a closed system or a unit.

Integrated financial planning also presents future operating results, net assets, and financial position. This not only shows the company's planned future results but also the structures of equity and debt capital, as well as cash flows and the resulting ability to service capital.

Reasons for integrated financial planning

Today, the need for integrated financial planning in companies is greater than ever. Current developments, such as digitalization and artificial intelligence, global market changes, new working models, and stricter regulatory requirements, make flexible and forward-looking financial planning essential.

Ultimately, it is dangerous to rely solely on the profit and loss account (P&L). This limited perspective does not provide a holistic view of your company's financial health and often results in strategic mistakes. Without an integrated view of finances, you cannot accurately predict how key factors such as cash flow, operational results, or key balance sheet data will impact your business planning.

This is the great advantage of integrated financial planning. It makes it possible to react quickly to changing conditions and to take proactive measures to ensure financial stability. This added value is particularly beneficial during times of crisis, as CFOs can utilize integrated financial planning to identify financing gaps early on or anticipate fluctuations in working capital. However integrated financial planning is not only important during periods of uncertainty. It is always important to have a comprehensive overview of the company's financial situation in order to be able to make informed decisions.

In addition, integrated financial planning enables banks, stakeholders, lenders and capital providers to better assess your liquidity situation. It is therefore essential if you want to provide investors with transparency in your financial planning.

The importance of integrated financial planning for meeting certain legal requirements also cannot be overstated. These requirements ensure transparency and stability, especially in the case of limited liability company forms. The aim is to ensure that companies are financially healthy and conduct their business on a sound basis. Understanding these regulatory requirements is essential for CFOs and finance leaders to ensure compliance and make the company financially strong and future-proof. The liquidity forecast is also of particular importance, serving as an early warning system for the company's financial stability as well as showing whether the company will be able to meet its obligations in the coming months.