Your payment transfers and banking operations shouldn't be complicated, and they certainly shouldn't incur you any risks.

For companies, secure and efficient payment transactions are crucial. And this is exactly where the EBICS standard comes into play. By implementing this standard, you can conduct transfers, direct debits, account inquiries, and other banking operations securely and seamlessly, directly from your banking software.

In this article, you'll discover how the EBICS standard works, the benefits it offers for automating your banking processes, and how you can leverage it alongside appropriate banking software to save you time and reduce stress.

What is EBICS?

EBICS is a European standard for secure data exchange between corporations and financial institutions. Since 2006, it has allowed companies to conduct all banking transactions directly from their finance software – without the need for external portals or manual TAN input. EBICS supports all standard banking services such as transfers, cash management, direct debits, checks, and standing orders.

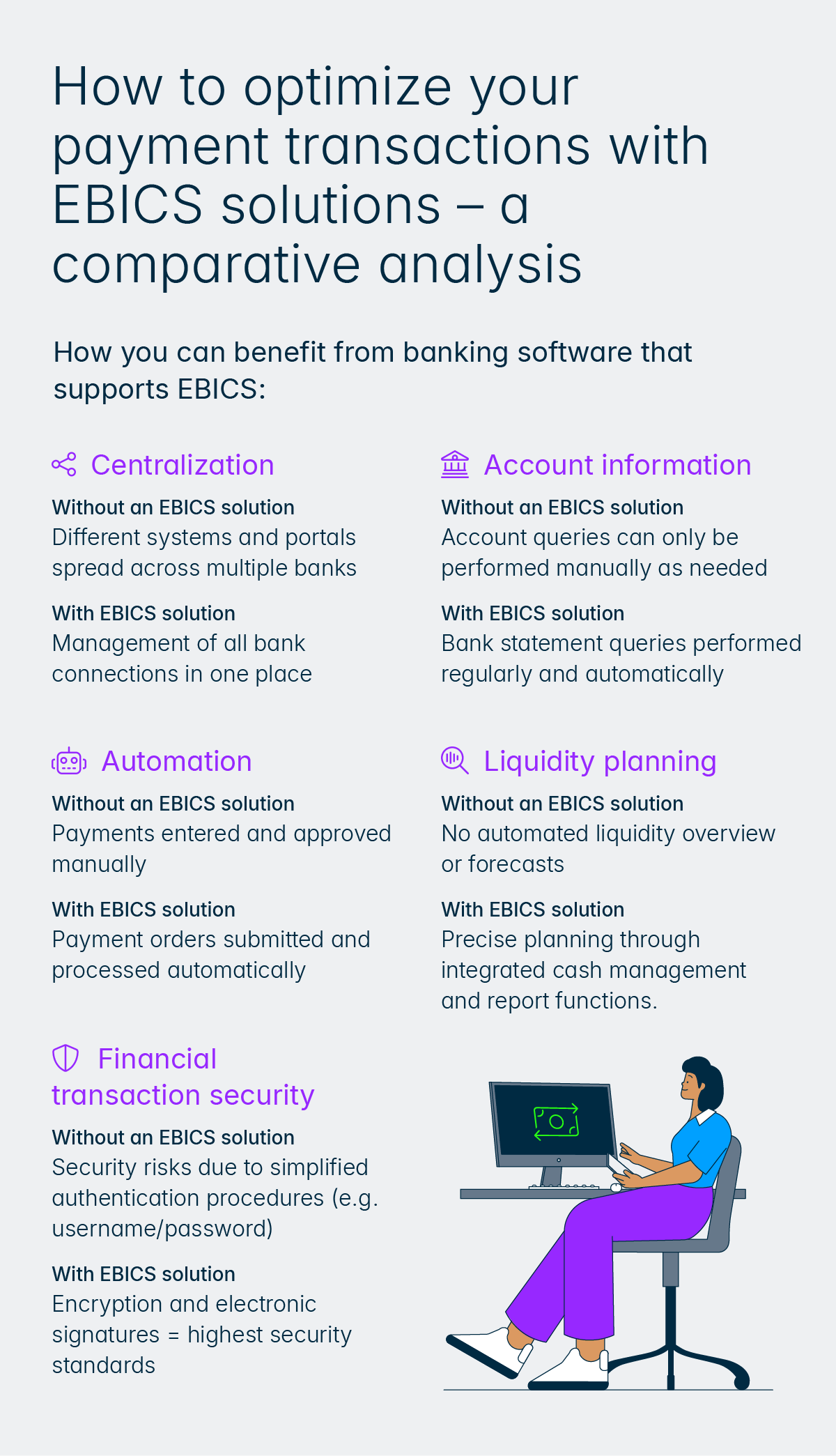

What are the benefits of EBICS?

- Secure transfer: Financial data is protected by comprehensive encryption.

- Centralized bank account management: All your banking can be managed through a single interface.

- Automation: Routine operations such as transfers and account queries are automated – minimizing errors and saving resources.

- Global deployment: EBICS is supported in several European countries and is ideal for companies operating internationally.

The new version of EBICS 3.0 also provides enhanced security features and standardizes the protocol across Europe. A seamless transition to this version by November 2025 is therefore advised.

How to successfully implement EBICS

EBICS is implemented in several phases. Your bank typically establishes a "mailbox" for your company, which your users can access using individual user IDs. All transactions are secured using RSA-based encryption and electronic signatures.

- Providing account information: Account statements, pending transactions, and other data relevant to your company are regularly posted to your mailbox by the bank. This data can be automatically retrieved.

- Submitting payment orders: Your company can send payment orders directly to the bank's EBICS mailbox. The bank checks these orders for completeness, authorization, and security, before releasing them for processing.

The most important steps in the initial stage:

- Applying to the bank: Define accounts and user permissions for EBICS access.

- Receive access data: The bank provides customer and participant IDs as well as access to the EBICS server.

- Initialization: With this data, the banking software is set up and secured via key transfer.

A key component is the Distributed Electronic Signature (DES), which allows for flexible approval of payment orders by multiple individuals – perfect for delegating tasks between various departments or external partners.

Can EBICS work without specialist banking software?

While some banks provide EBICS access directly through their online portals, these solutions are often limited in what they can do. Specialist software like Lucanet's Banking and Cash Management solution, however, provides maximum efficiency and control over payment transactions.

The benefits that the Lucanet EBICS solution offers you are:

- Centralization: All banking transactions are processed on a single platform.

- Automation: Payment processes and account queries are executed seamlessly and automatically.

- Liquidity Planning: Features like cash pooling and cash forecasting give you precise control over your liquidity.

- Maximum Security: A sophisticated authorization framework safeguards your data against unauthorized access.

- Flexibility: The browser-based interface provides you with access at any time — whether in the office or on the go.