The globalization of corporate accounting has long been part of the finance scene. In Germany, large capital market-oriented companies have been required to prepare their consolidated financial statements in accordance with IFRS for years. In the US, the Securities and Exchange Commission (SEC) generally requires financial statements to be prepared in accordance with US GAAP (Generally Accepted Accounting Principles); however, IFRS financial statements are also accepted for foreign groups.

In practice, consolidated financial statements in accordance with HGB remain of central importance: on one hand, the individual financial statements of German parent companies continue to be prepared predominantly in accordance with HGB commercial law provisions (e.g., SAP, BMW, Siemens, and Deutsche Bank). On the other hand, many unlisted but internationally active German groups prepare their financial statements in accordance with HGB. As a result, we are increasingly encountering the following situation:

For consolidated financial statements, international balance sheets must be converted into local accounting standards.

This is the case in our following fictional case study of SpielSchön GmbH, a long-established company from Freiburg. The toy company generated sales in the double-digit millions in 2022. It has several subsidiaries in Germany and Austria. Until now, there has been no need to deal with international accounting in any great detail. Until now, that is.

Practical example: SpielSchön GmbH acquires a US subsidiary (US GAAP according to HGB)

Let's assume you are the head of group accounting at SpielSchön GmbH. As the company grew, you introduced Lucanet as its planning and consolidation software a few years ago. Your company management has now decided to buy a competitor in the US – KiddyToy Inc. The aim is to drive forward the group's strategic focus on innovative business areas internationally.

What does this mean for you as head of group accounting? Currency translation, of course! But that comes at the very end. First, you have the arduous task of preparing a commercial balance sheet II (HB II) in accordance with HGB for a US GAAP company.

The thing is, anyone who is reasonably familiar with both accounting systems knows that the differences between the two could hardly be greater.

US GAAP and HGB: Historical development of accounting

Why is that? As is so often the case, a look at history helps. At the beginning of the 20th century, the state still had sovereignty over monetary policy and the money supply in Germany. Since the state coffers were more often empty than full even back then, a lot of money was printed. This led to inflation with all its devastating consequences for the economy. As a lesson learned from this, legislators in this country placed a strong emphasis on creditor protection in commercial law.

The situation is different in the United States. There, the focus of accounting has always been on investors and their interest in information. The principle of “fair presentation,” i.e., economically appropriate presentation, applies rather than the “principle of prudence.” After the stock market crash of 1929, the Securities and Exchange Commission (SEC) was founded to regulate securities trading in the United States.

Accounting shaped by tax law and legal tradition

Accounting systems also reflect historically developed differences in legal traditions and tax law conditions. While case law in this country is based on the German Civil Code (BGB), case law based on precedents prevails in Anglo-Saxon countries. It is therefore not surprising that German accounting rules are enshrined in law; the German Commercial Code (HGB) came into force together with the Civil Code (BGB) on January 1, 1900.

The American accounting rules are different. Until the 1970s, the American Institute of Certified Public Accountants (AICPA), the national professional association of American accountants, was tasked with creating uniform accounting standards. Today, the Financial Accounting Standards Board (FASB) is responsible for the US GAAP rules. However, these are not laws. And the application of US GAAP is not generally mandatory. However, an unqualified audit opinion from the auditor requires compliance with it. And the SEC requires its application for listed companies.

Differences in the distribution and taxation function between US GAAP and HGB

There are also differences regarding the distribution and taxation function. In Germany, this is always based on the individual financial statements. Companies in the United States follow the regulations of the state in which they are based. And these state laws sometimes differ significantly in terms of distribution. There was and is no equivalent to the German principle of authoritativeness in the US.

It is therefore not surprising that, despite all international efforts toward convergence, significant differences still exist between the individual accounting standards.

US GAAP according to HGB – transition from one accounting system to another

There are two ways to transition from American to German accounting:

- Parallel accounting (In addition to US GAAP financial statements, original financial statements are prepared simultaneously in accordance with HGB.)

- Classic transition to HGB based on US GAAP financial statements

Back to our fictional case study: Since KiddyToy Inc.'s accounting department does not seem motivated or technically capable of parallel accounting, you quickly decide on the transition. True to the motto: better to do it wrong yourself than to be completely wrong.

You discuss with your trusted auditor whether the reconciliation to HGB could be dispensed entirely with reference to Section 308 (2) No. 3 f. HGB. Because the differences are not that material, you say. He sees it differently. Too bad.

Shortly after July 31, 2023, the first reporting date after the acquisition, you find the following in your email inbox: an Excel file with the file name “KiddyToy Financial Statements July 2023 (Prelim)”. But, surprise! Unfortunately, the file does not quite meet your format requirements. Thanks to Lucanet's flexible import function, your experienced team was able to import the file into Lucanet a short time later.

Don't forget: Americans use a period as a comma and vice versa when writing numbers. Internationally, balance sheets are often structured in descending order of liquidity. This means that they begin with short-term liquid assets (cash).

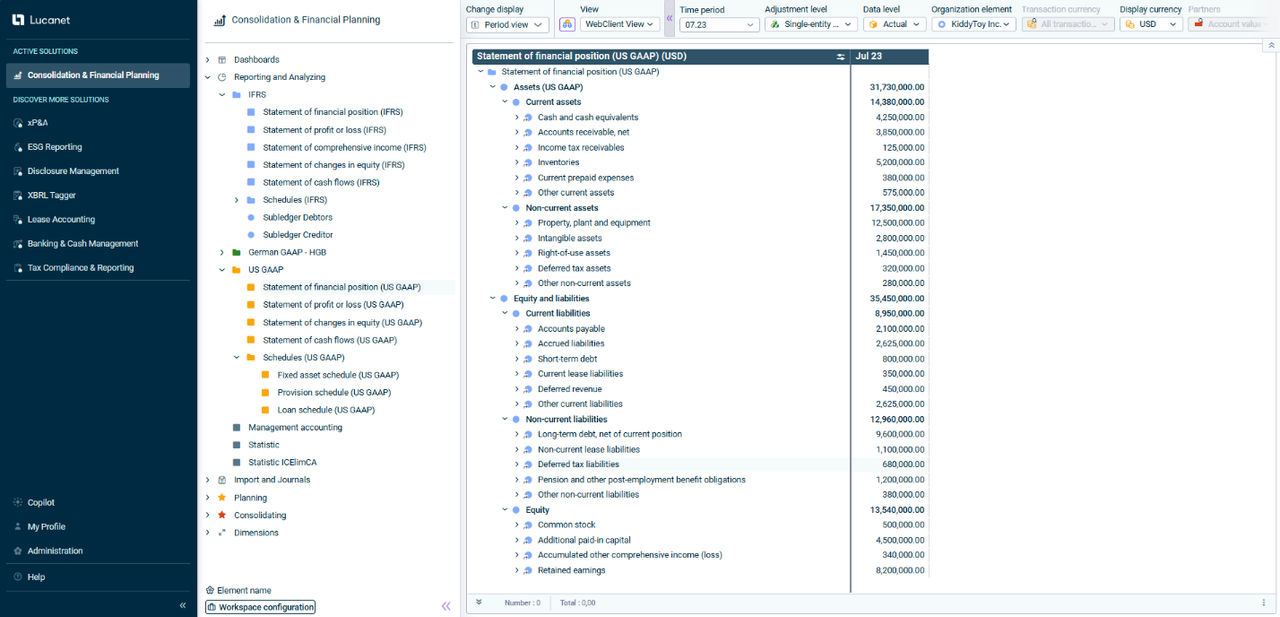

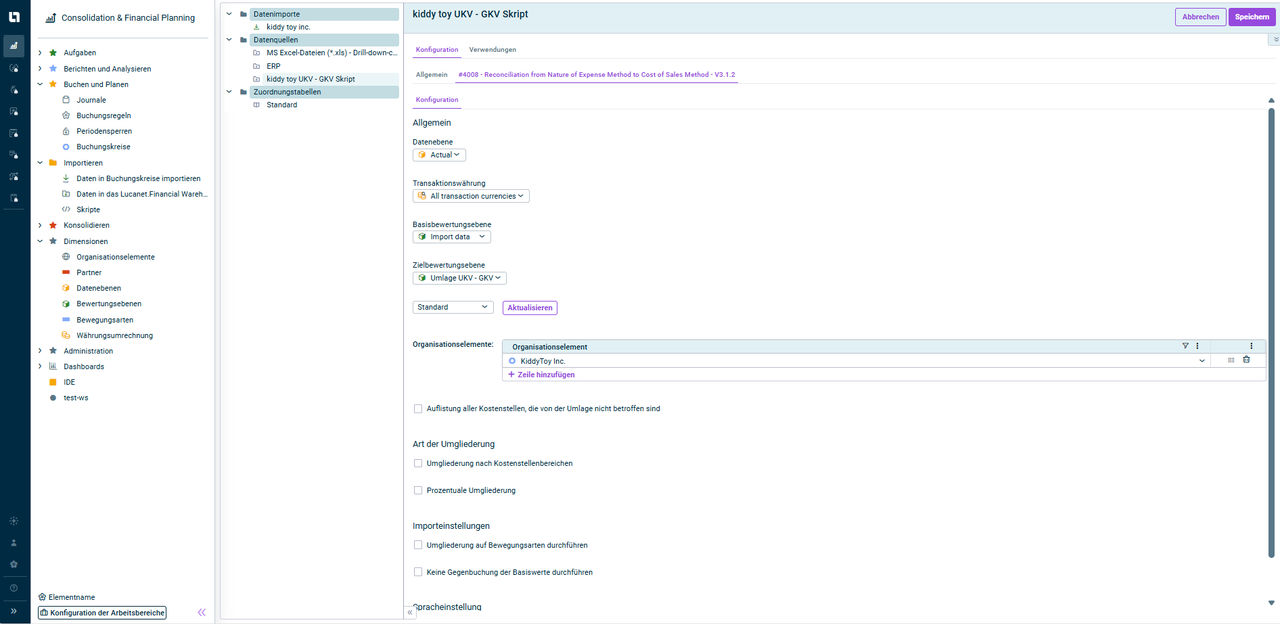

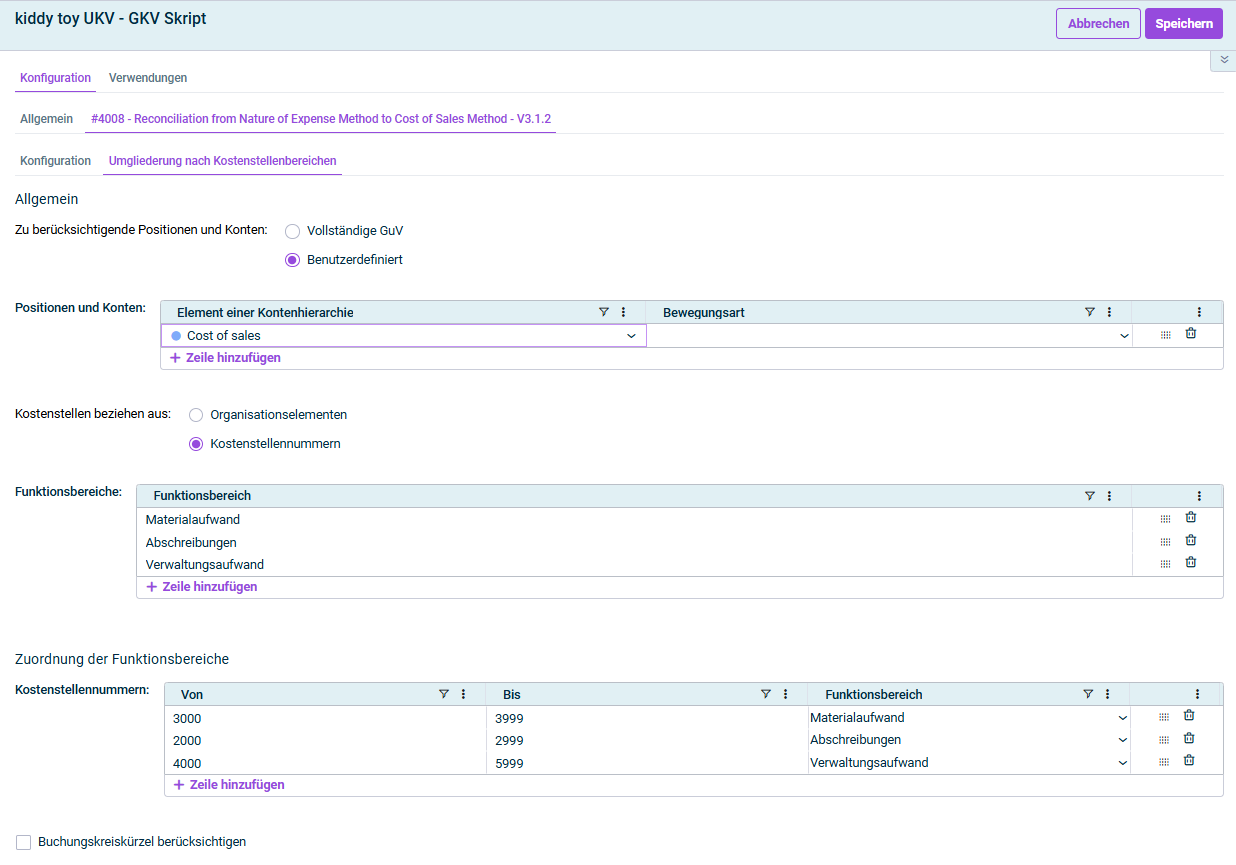

In order to be able to analyze KiddyToy's figures in Lucanet in the original US GAAP structure, a derived balance sheet and income statement (profit and loss statement) is created in accordance with US GAAP. To ensure that the transition in Lucanet remains transparent, a new valuation level “Transition” is created.

Practical tip for transitioning from US GAAP to HGB: The transformation of an international balance sheet into a commercial balance sheet can be transparently displayed in Lucanet by mapping the transition entries in separate valuation levels. When reorganizing local accounts into an HGB structure, it is advisable to check the assignment status to ensure that all accounts are transferred completely.

After successfully importing and assigning the items in Lucanet, you can view KiddyToy's US GAAP balance sheet in the Lucanet Consolidation and Financial Planning solution: