Being a CFO has never been easy.

But right now, it’s more demanding than ever.

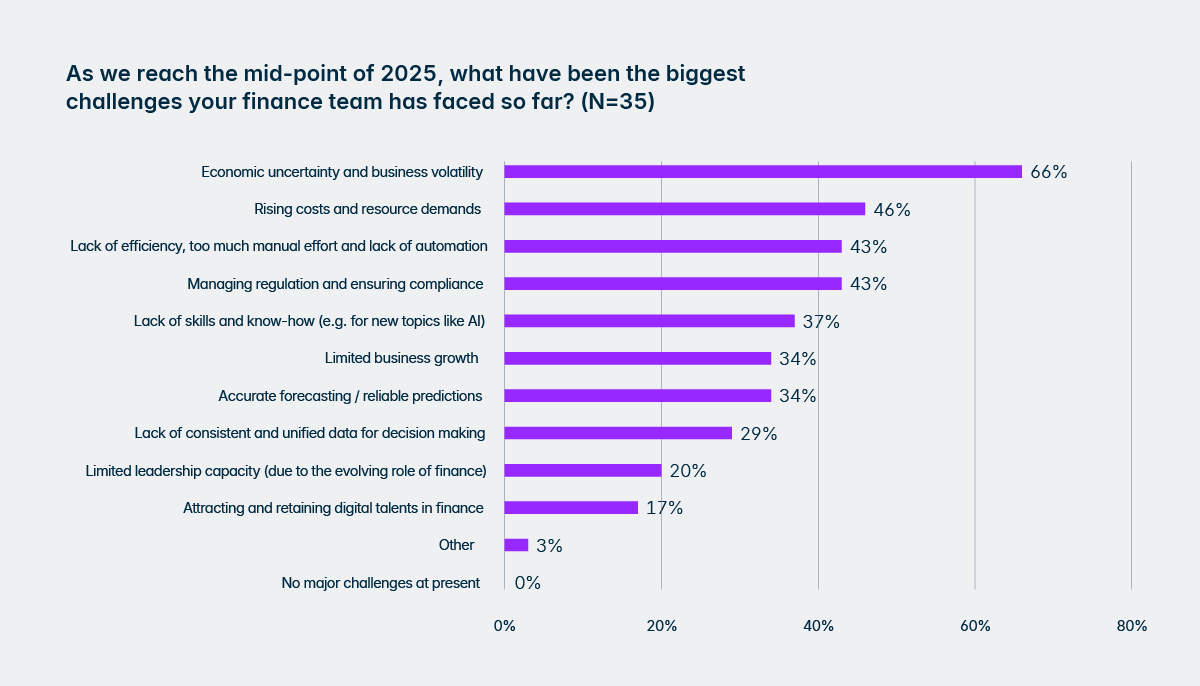

Tariffs, inflation, new regulatory pressures – the playing field keeps shifting, and expectations are rising just as fast. Still, many finance leaders are finding ways not just to cope, but to turn today’s challenges into opportunities for growth and innovation.

The latest insights from our “Finance Leadership Panel” – featuring top European CFOs and finance executives – reveal how successful leaders are turning uncertainty into strategic advantage. In this post, you’ll discover practical, battle-tested strategies to help you lead with confidence through turbulent times.

About the Lucanet Finance Leadership Panel 2025

We invited a panel of 35 European CFOs and finance leaders to discuss today's business realities and identify new strategies for building resilience, creating value, and demonstrating confident leadership. To contextualize and validate their responses, we compared them with the latest research from third-party analysts, such as IDC. You can download the full report for free here:

Get Finance Leadership Panel Report

How CFOs are turning economic challenges into action

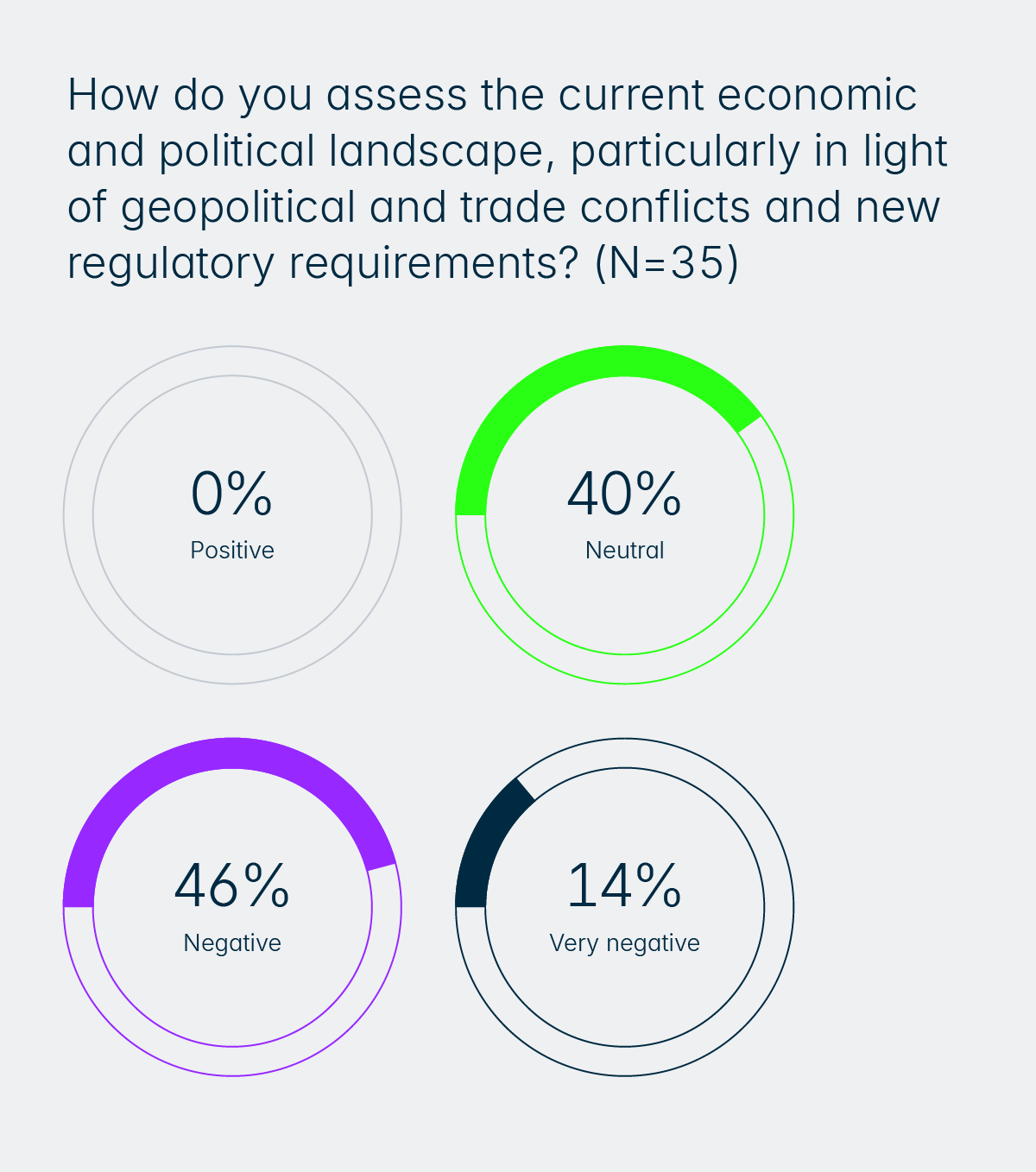

60% of our expert panel view the current economic climate as negative or very negative.