In 2024, ESG reporting was a race to keep up with expanding regulations.

In 2025, ESG reporting is still a race to keep up with regulations, but it has also become a core management function, shaping resilience and long-term value creation.

BARC's latest report, "The State of ESG & Sustainability Reporting: Laying Out the Roadmap for 2025", examines how organizations are navigating this transition. Based on insights from 235 global companies, it compares experiences across industries, regions, and organizational setups, revealing where businesses stand today and what they must do to move ahead.

Let’s unpack the key findings and explore what you can do to make your ESG reporting stronger and more impactful.

Many companies are only just getting started

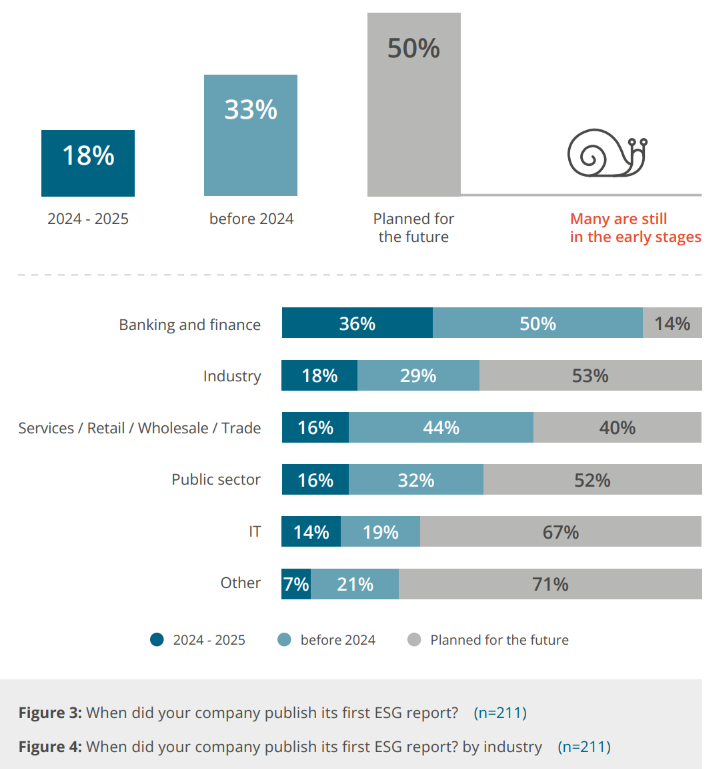

ESG reporting is still new territory for many companies. Only one-third of these companies had published their first ESG report before 2024, while another 18% followed in 2024–2025.

Yet, about half of the companies surveyed still plan to publish their first report in the future. This is largely because many large non-listed EU companies are not required to report until the 2025 financial year, with publication expected in 2026. Many are sticking to that official timeline and have yet to prioritize ESG reporting.

By contrast, companies that started early often faced stricter regulations or pressure from investors and customers. The overall picture shows that, for many, the ESG journey has only just begun.