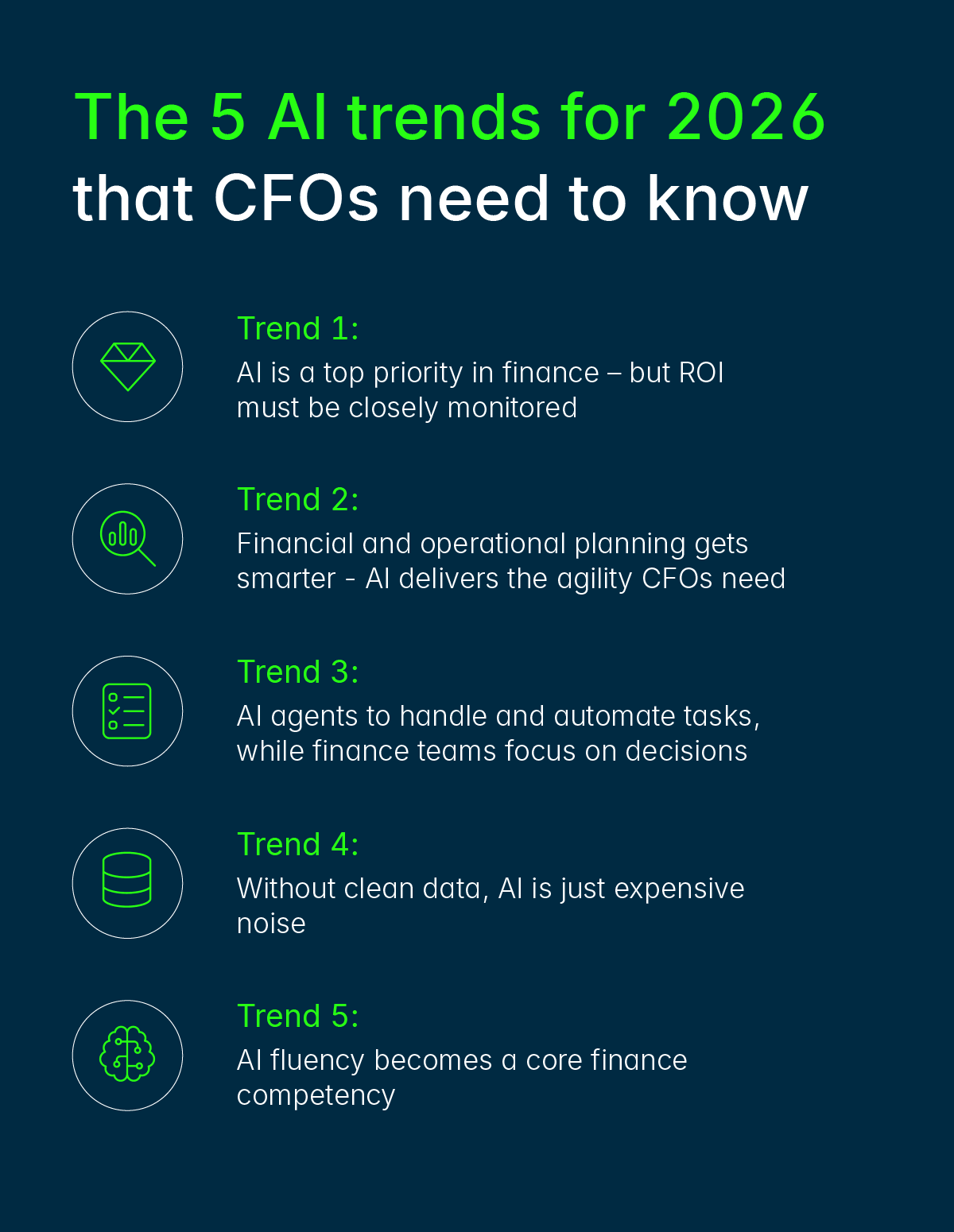

Trend 1: AI is a top priority in finance – but ROI must be closely monitored

Finance and tax teams have clearly made AI a strategic priority. But investment alone doesn't guarantee success. In 2026, the focus shifts decisively from experimentation to measurable value creation – and that requires close monitoring of ROI and business impact.

The reality check is sobering: According to BCG1, the average AI ROI in finance to date is around 10%, while many companies are targeting more than 20%. About one-third of finance leaders report that they have seen little noticeable value so far. The causes are often expensive pilot projects that fail to make the leap into production or are not scaled consistently.

For CFOs, this means establishing clear governance around AI investments: defining measurable success criteria upfront, implementing regular ROI reviews, and being willing to redirect or stop initiatives that don't deliver. The winners in 2026 won't be those who experiment the most – they'll be those who systematically prove value and scale what works. Organizations that drive this forward with discipline turn AI from a strategic priority into a true competitive advantage.

Trend 2: Financial and operational planning gets smarter - AI delivers the agility CFOs need

In a world full of uncertainty, forward-looking financial and operational planning is the ultimate discipline – and AI is its most important ally.

Traditional planning relies on static spreadsheets and manual data wrangling – slow, error-prone, and always outdated. AI changes that: it processes real-time data, runs hundreds of scenarios in minutes, and adapts as conditions change.

Deloitte reports that finance leaders will increasingly rely on advanced scenario planning in 2026. AI systems analyze current data and simulate alternative developments – for example, market trends, exchange rates, or supply chain disruptions. This makes it possible to identify impacts faster and evaluate them more effectively.

A PwC analysis shows that using AI in financial planning can increase forecast accuracy and speed by up to 40%,

AI-powered forecasting assistants handle data collection and cleansing, allowing analysts to focus on interpretation and deriving actions.

For CFOs, this means greater agility and room to maneuver when it matters most. Financial and operational plans can be updated more frequently, opportunities and risks addressed earlier, and strategic decisions made consistently on a data-driven basis.

Trend 3: AI agents to handle and automate tasks, while finance teams focus on decisions

Finance teams lose significant time on repetitive tasks: data entry, reconciliations, error checks. AI agents are changing that. These intelligent digital assistants independently execute defined tasks, automating repetitive work, speeding up closes, and freeing up resources for strategic priorities.

According to Gartner, knowledge management, accounts payable invoice processing, and error/anomaly detection are already among the most common AI use cases in finance departments. For example, inbound invoices today are automatically matched to purchase orders and posted by AI systems. PwC reports that this can reduce cycle times by up to 80%.

The financial close also benefits. AI agents support intercompany reconciliations, identify posting errors or missing documentation, and handle routine consolidation steps. In financial reporting, AI tools are increasingly used to create drafts for management reports or disclosures in the notes.

Lucanet's CFO Solution Platform brings these benefits to life. Our cloud-based platform combines proven finance expertise with powerful GenAI capabilities through an Intelligence Core with integrated AI agents. From the Consolidation and Financial Planning Copilot that accelerates data queries and deepens analysis for more precise insights, to the Copilot for Disclosure Management ensuring consistent tone and terminology in reports, and the Tagger Agent that automates tagging and drastically reduces time spent on manual effort – Lucanet transforms routine tasks into automated workflows. The platform also features AI-powered forecasting, intelligent formula creation, and natural language querying with automatic chart visualization, enabling finance teams to shift from reactive to strategic work.

Trend 4: Without clean data, AI is just expensive noise

Even the best AI is useless if the underlying finance data is incomplete or inconsistent. Garbage in, garbage out – but with AI, the consequences are faster, more expensive, and harder to detect.

In 2026, data quality has become a central differentiator for successful AI use in finance. CFOs are responding by investing more heavily in data harmonization and integrated platforms that connect planning, closing and reporting processes. Creating a single source of financial truth that AI can actually rely on.

But clean data alone isn't enough. As AI models increasingly influence operational and strategic decisions, AI governance is becoming just as critical. Finance leaders are establishing guidelines for AI use, defining clear responsibilities for data and models, and introducing validation processes that make AI results auditable. PwC observes that CFOs in 2026 are specifically working to make AI outputs explainable and compliant in order to build trust with the executive team, auditors, and regulators.

New risk areas are also emerging. Uncontrolled AI use by employees (“shadow AI”) as well as AI-enabled fraud attempts require clear guardrails and both technical and organizational countermeasures. Without proper governance, AI becomes a compliance liability rather than a strategic asset.

The bottom line: The ability to operate AI securely, in a controlled manner, and responsibly will become a core finance capability in 2026. Companies with a stable data foundation and robust governance create the prerequisites for sustainable AI success. Those without it risk turning AI into an expensive, uncontrollable black box.

Trend 5: AI fluency becomes a core finance competency

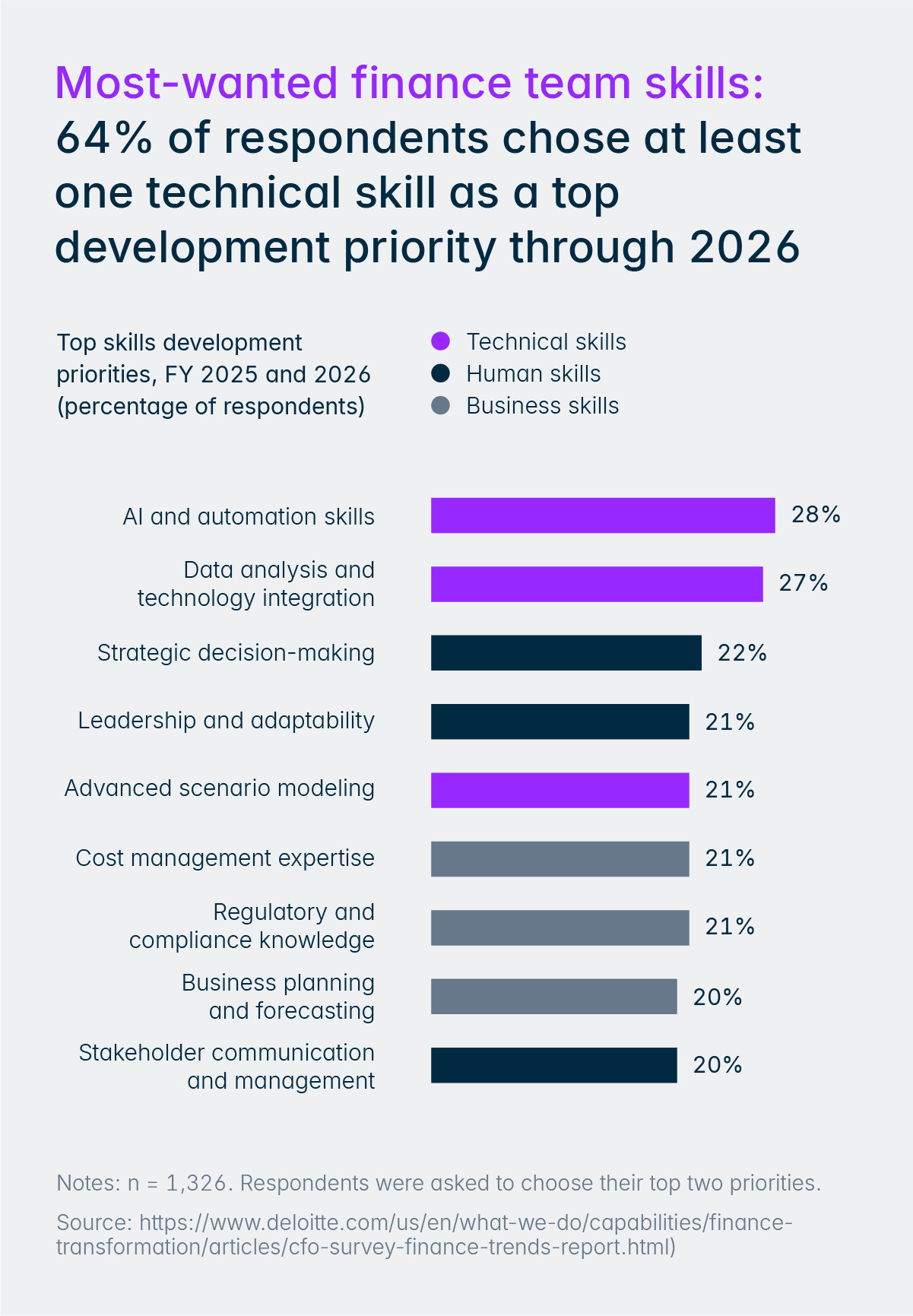

AI is changing not only tools and processes, but also role profiles within the finance organization. The finance professional of 2026 needs a new skill set –one that combines traditional accounting expertise with AI fluency.

Finance teams will increasingly work in so-called “Human + Agent” workflows in 2026. AI agents take over data-intensive routine tasks such as data preparation, reconciliations, forecast updates, or outlier detection. Humans focus on what AI can't do: interpretation, scenario evaluation, and strategic decision-making.

This division of labor increases productivity, especially when resources are limited. But it only works if finance teams understand how to work with AI. Data literacy and a basic understanding of AI are no longer nice-to-have skills. They're essential. Finance employees need to know how AI models work, how to validate their outputs, and when to trust (or question) AI-generated insights.

Deloitte observes that finance functions are therefore increasingly integrating tech talent.