AI is no longer a distant promise—it's revolutionizing how finance teams operate every day, opening up powerful new ways to work smarter, faster, and with more confidence. Across the financial landscape, professionals are discovering how modern AI tools can automate repetitive tasks, surface valuable insights, and unleash more time for creative, strategic thinking.

This is an exciting time to be in finance. Whether you’re just taking your first steps or looking to level up your team’s capabilities, AI offers real, tangible opportunities to simplify your workflow and supercharge your decision-making.

In this post, you’ll explore where AI is making the biggest impact, understand the hurdles teams are overcoming, and discover practical ways you can take advantage of this technology as you prepare for the next era of financial leadership.

IDC survey: 96% of finance teams are testing or piloting AI

Finance teams today are navigating more complexity than ever. And there’s increasing pressure to do more with what you have – often without adding headcount.

That’s where AI can help. And many teams are already seeing value, especially in areas with large data volumes and repeatable processes.

According to an IDC survey, 96% of respondents said they are currently testing or piloting AI technology in their finance department.1

Let's take a look where it is used the most.

In what areas is the adoption of AI the strongest?

These areas have become early entry points for AI in finance:

- Automating routine work

- Speeding up reporting

- Supporting forecasts

- Finding patterns in large data sets

As you can see, AI has been implemented across different areas of finance, especially in rule-based, repetitive areas involving large data sets and a high number of transactions.

Implementation is less common in areas with more strategy and complexity, such as tax, financial governance, risk and compliance, treasury, and mergers and acquisitions.

That is totally understandable. Users want to become familiar with the technology and recognize its potential before taking on more complex projects.

The most common AI roadblocks

As AI is still in the “early days” of development, there are still a lot of challenges to be dealt with. These are the common roadblocks finance teams face, when dealing with AI:

Poor data quality: AI can’t deliver useful insights if the data is messy.

Integration issues: Many companies still run on ERP systems that don’t play well with AI.

Compliance and trust: It’s hard to explain how AI came to a decision. That’s a problem when auditors or regulators ask questions.

Skills gap: Teams need to learn how to use AI properly – and how to challenge the results.

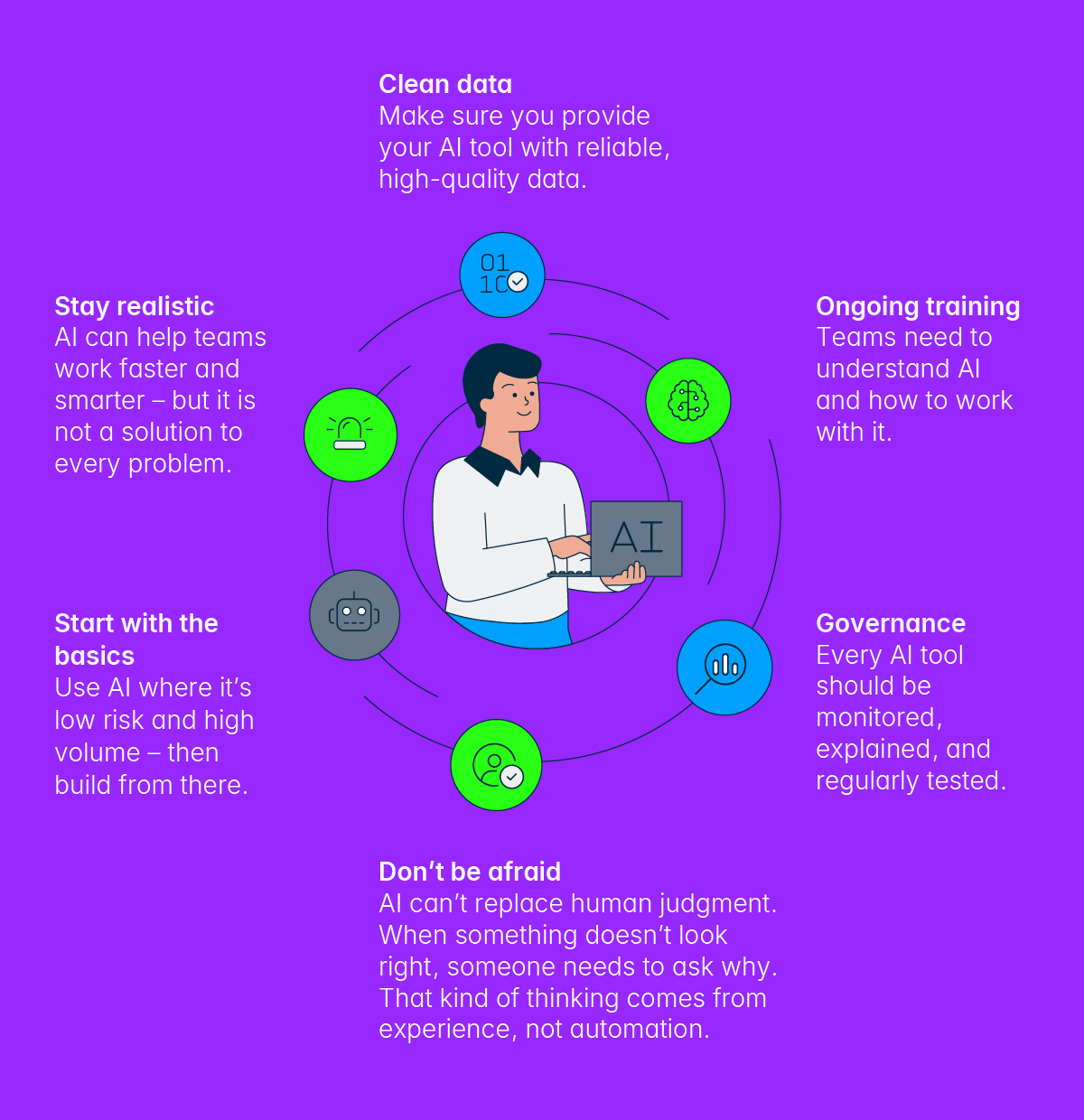

How finance teams can get the best out of AI

To effectively take advantage of AI, finance teams must proactively prepare for this technological shift.

Here’s what finance leaders should focus on: