Environmental, social and governance (ESG) management has become a top priority for companies across all industries. It is a business and regulatory imperative and high on the C-suite agenda. As a result, ESG regulations and requirements were ranked by CEOs as the number one business risk in Europe in 2023, ahead of cybersecurity and economic concerns 1. ESG reporting is widely used by companies for transparency, comparability and accountability to various stakeholders. The different regulatory frameworks make ESG appear primarily as a legal necessity. However, ESG is much more than that. When ESG is established as a strategic pillar in your long-term business strategies, you can see it as an opportunity with massive impact and growth potential. Learn more on the potential challenges of ESG reporting and how finance professionals can overcome them with adopting a professional ESG reporting solution.

Current status of ESG reporting and challenges faced by finance professionals

ESG reporting can be challenging due to the lack of readily available data for most companies. With data scattered across multiple sources and functional silos, there is limited visibility and control over ESG data. When ESG is not operationalized, finance departments struggle to measure, monitor, manage, and report progress effectively.

Statistics reveal the current state of ESG reporting 2:

- 36% of companies have just started identifying and collecting ESG data

- 20% have visibility and are monitoring at least 75% of their ESG data

- Only 3% have a complete view of their ESG data

As a result of poor data tracking, many finance departments find it challenging to measure their environmental impact and quantify the business impact of ESG investments. Without clear visibility and control of ESG data, companies struggle to demonstrate the ROI of their sustainability efforts.

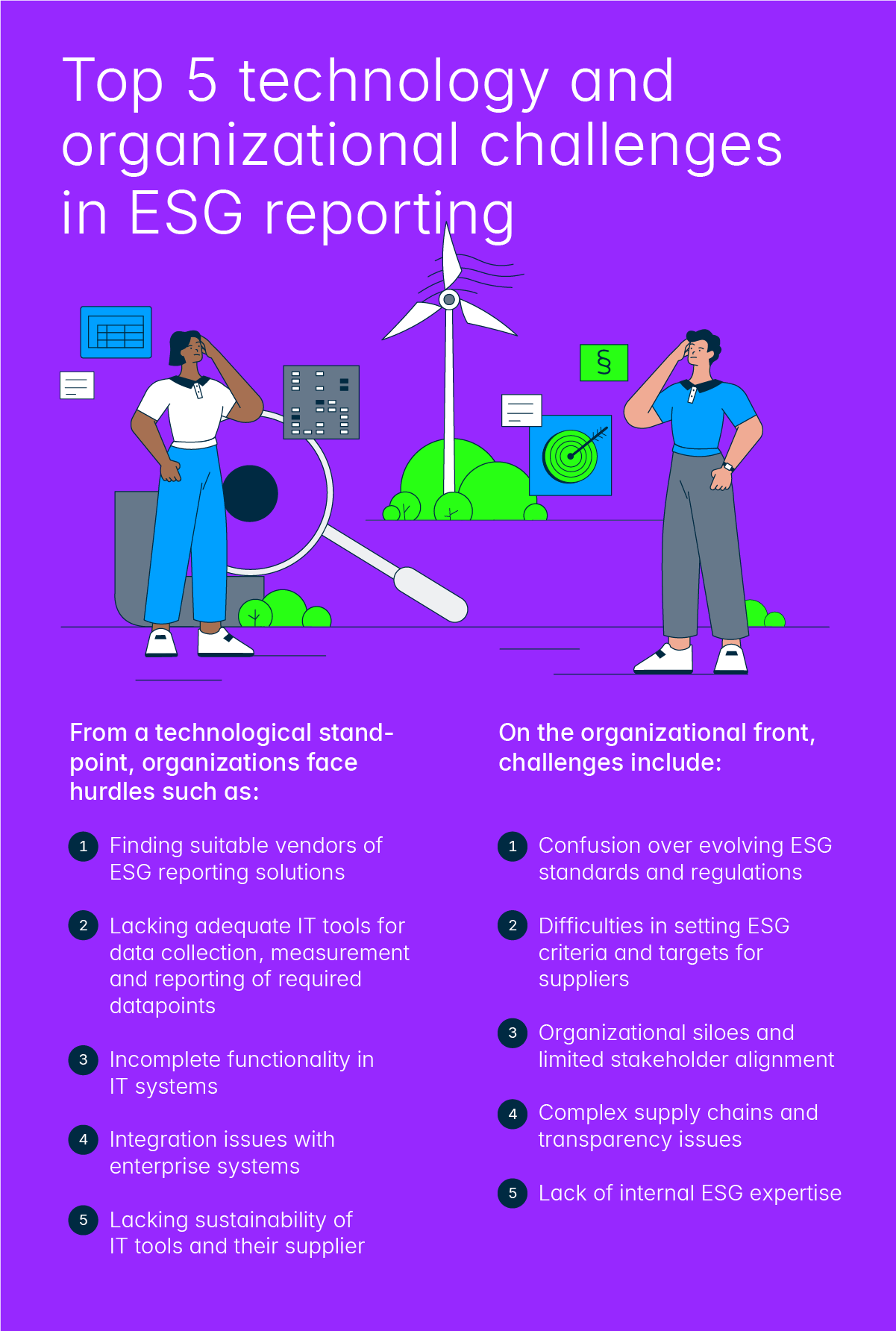

Navigating the top 5 technology and organizational challenges in ESG reporting

Research shows that companies face ESG reporting challenges on two different levels: technological and organizational 3. Let's take a look at them: