ESG or Environmental, Social, and Governance factors are fast gaining importance in the C-suite. Many choices made there must pass through an ESG lens in addition to the economic lens that used to be the yardstick for many decisions. Where’s the CFO in all this? Busy doing financial reporting or at the center of the engine room crafting the company’s sustainability strategy?

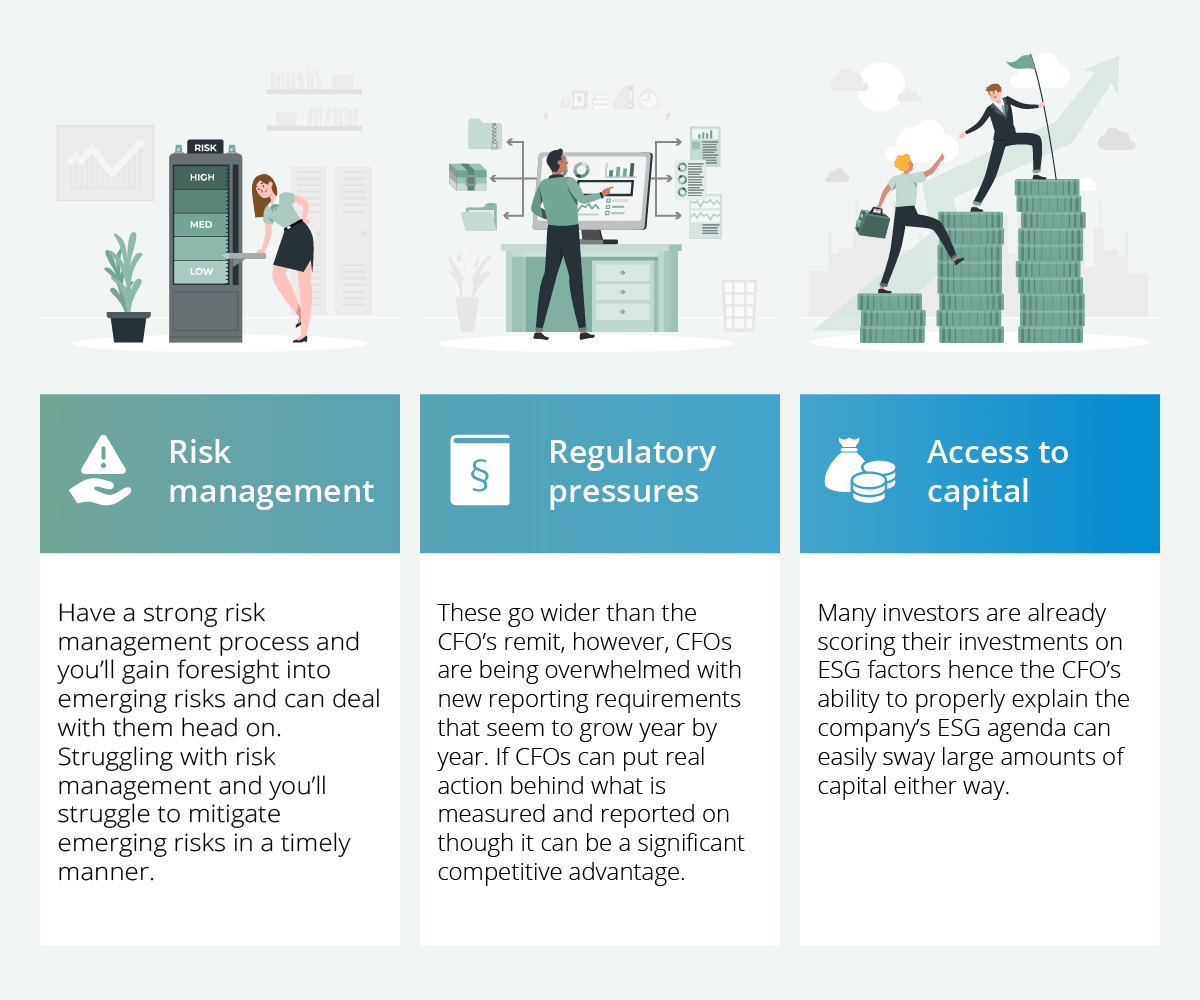

Let’s first look at why ESG is gaining importance, how it impacts company performance, and finally what role the CFO should play in all this. There are multiple reasons such as stakeholder expectations, risk management, regulatory pressures, access to capital, talent attraction and retention, and reputation and brand enhancement.

It’s clear that these mostly outside pressures forces management into action as they can no longer be ignored. One such example is the large-scale green energy transition that’s going on where former oil and gas majors have started to invest heavily into sustainable energy sources.

ESG – a double-edged sword

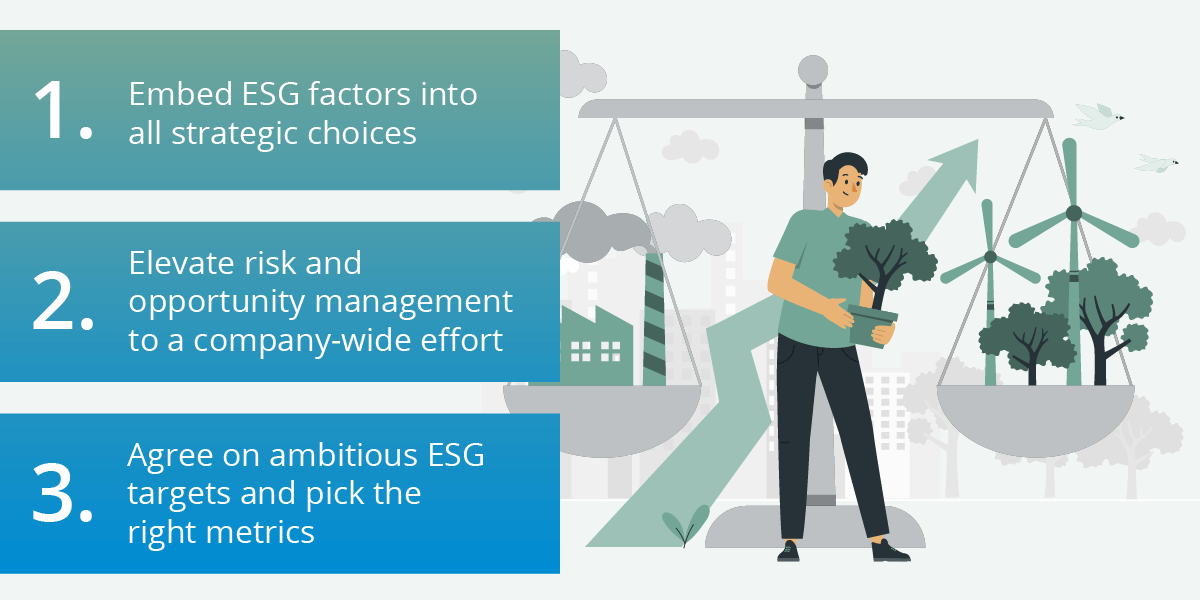

Dealing with ESG factors can be challenging as each of them presents both opportunities and risks. For each factor you can easily highlight both and the only thing that’s certain is that ignoring them will be a risky decision. Looking at it from a CFO’s perspective we could highlight the following.