The international taxation landscape evolves continuously, introducing us to new groundbreaking transformations now and then. Pillar 2, a dynamic and visionary component of the OECD/G20 Inclusive Framework's master plan for reforming global taxation, has been getting a lot of attention lately. Find out what exactly is Pillar 2, and why it’s capturing the attention of governments, multinational enterprises (MNEs), and tax professionals around the world.

Definition and Meaning of Pillar 2

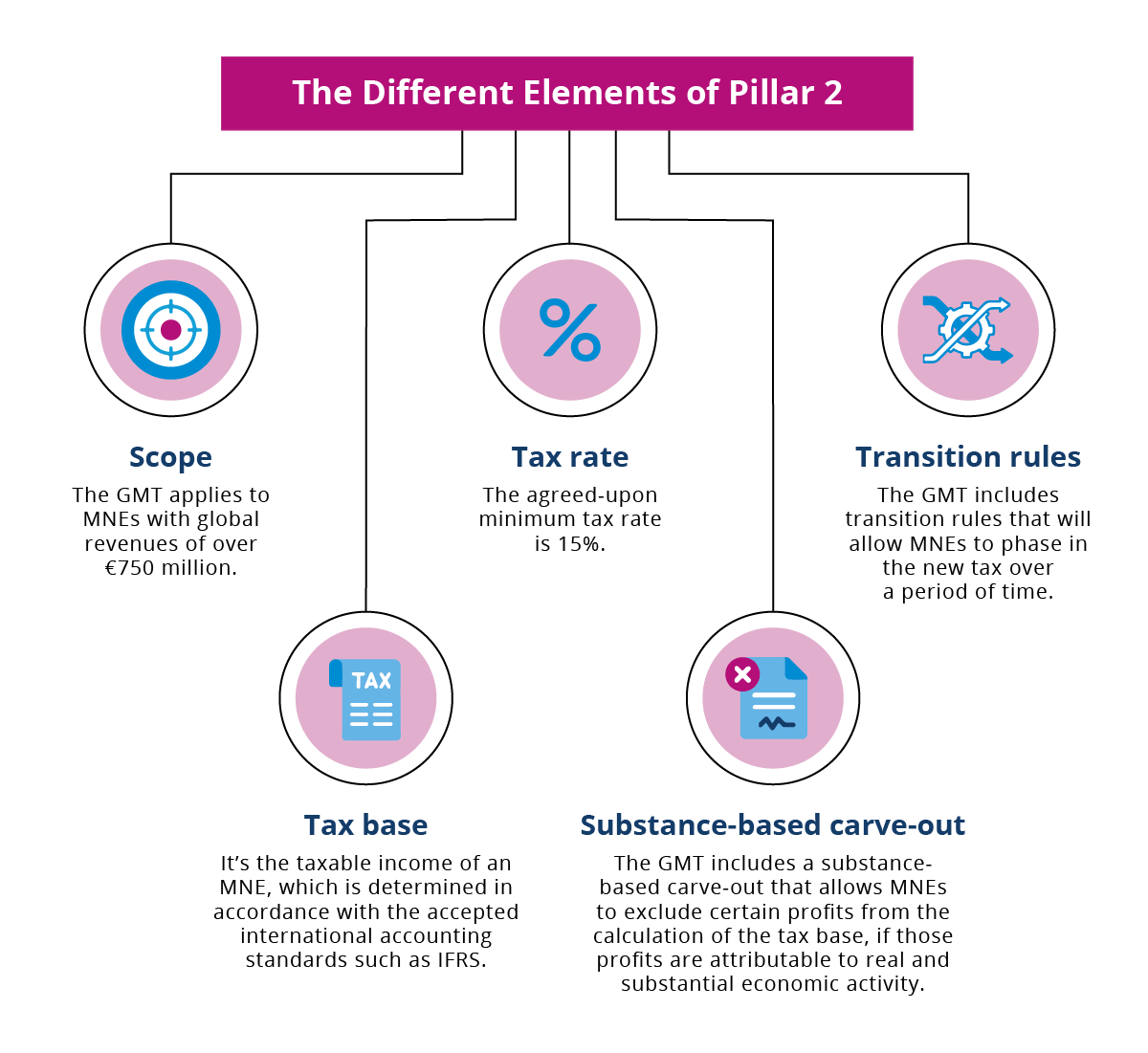

Pillar 2 is one of two pillars of the OECD/G20 Inclusive Framework's plan to reform international taxation. With 139 member countries, Pillar 2 is designed to establish a global minimum tax (GMT) of 15% on the income of MNEs with a global turnover of at least €750 million. The GMT consists of the Income Inclusion Rule (IIR) and the Undertaxed Profits Rule (UTPR).

- The IIR requires MNEs to pay a top-up tax for jurisdiction where the effective tax rate is below the agreed-upon minimum rate.

- The UTPR is a secondary mechanism to collect top-up tax in certain cases where the IIR would not result in a top-up tax.

Pillar 2 is expected to come into effect in 2024, but the exact date will vary from country to country. For instance, the European Union (EU directive) has said that it will implement Pillar 2 from 2024, while the United States has not yet announced a date. However, some countries, such as Germany and Indonesia, have already started to implement Pillar 2 rules.

Difference Between Pillar 1 and Pillar 2

In general, Pillar 1 primarily deals with the reallocation of income to market jurisdictions, while Pillar 2 focuses on establishing a global minimum taxation framework and preventing tax avoidance. Here’s a detailed overview:

Pillar 1: Profit Allocation and Nexus

Pillar 1 focuses on the reallocation of taxable income to market jurisdictions for large multinationals and affects effective tax rates, cash tax obligations, and transfer pricing arrangements. Intended to include an increasing number of entities over time, Pillar 1’s timeline for introduction depends on acceptance by a critical mass of jurisdictions.

Pillar 1 repeals digital services taxes and similar measures, with unclear identification and timetable, while covering various industries, moving away from the initial focus on digitalized business models.

Pillar 2: Global Minimum Taxation

Pillar 2 aims to ensure income is taxed at an appropriate rate and establish a GMT of 15% for multinationals with €750 million+ turnover. Model Global Anti-Base Erosion (GloBE) rules are released under Pillar 2, and it’s expected to be implemented by the European Union and other jurisdictions from 2024–2025.

Pillar 2 introduces a radical shift in the tax landscape and involves various mechanisms, including the Undertaxed Payments Rule (UTPR) and Subject to Tax Rule (STTR).

Main Goals and Benefits of Pillar 2

The main goal of Pillar 2 is to prevent MNEs from shifting profits to low-tax jurisdictions in order to reduce their tax liability. Pillar 2 will generate billions of dollars in additional tax revenue for governments around the world and is intended to create a more level playing field for businesses, offer a more competitive business environment and establish a fairer tax system.