In recent years, the reporting obligations of certain companies have continually increased under German law. Think of the payment reports required by the German Commercial Code (HGB), the reports stipulated by the Transparency in Wage Structures Act (EntgTranspG), the declarations of completeness specified by Germany's legislation on packaging (VerpackG), or the reports described by the Supply Chain Due Diligence Act (LkSG). For fiscal years after June 21, 2024, companies with certain characteristics will also need to submit public country-by-country reports.

Another weapon in the fight against tax evasion and fraud

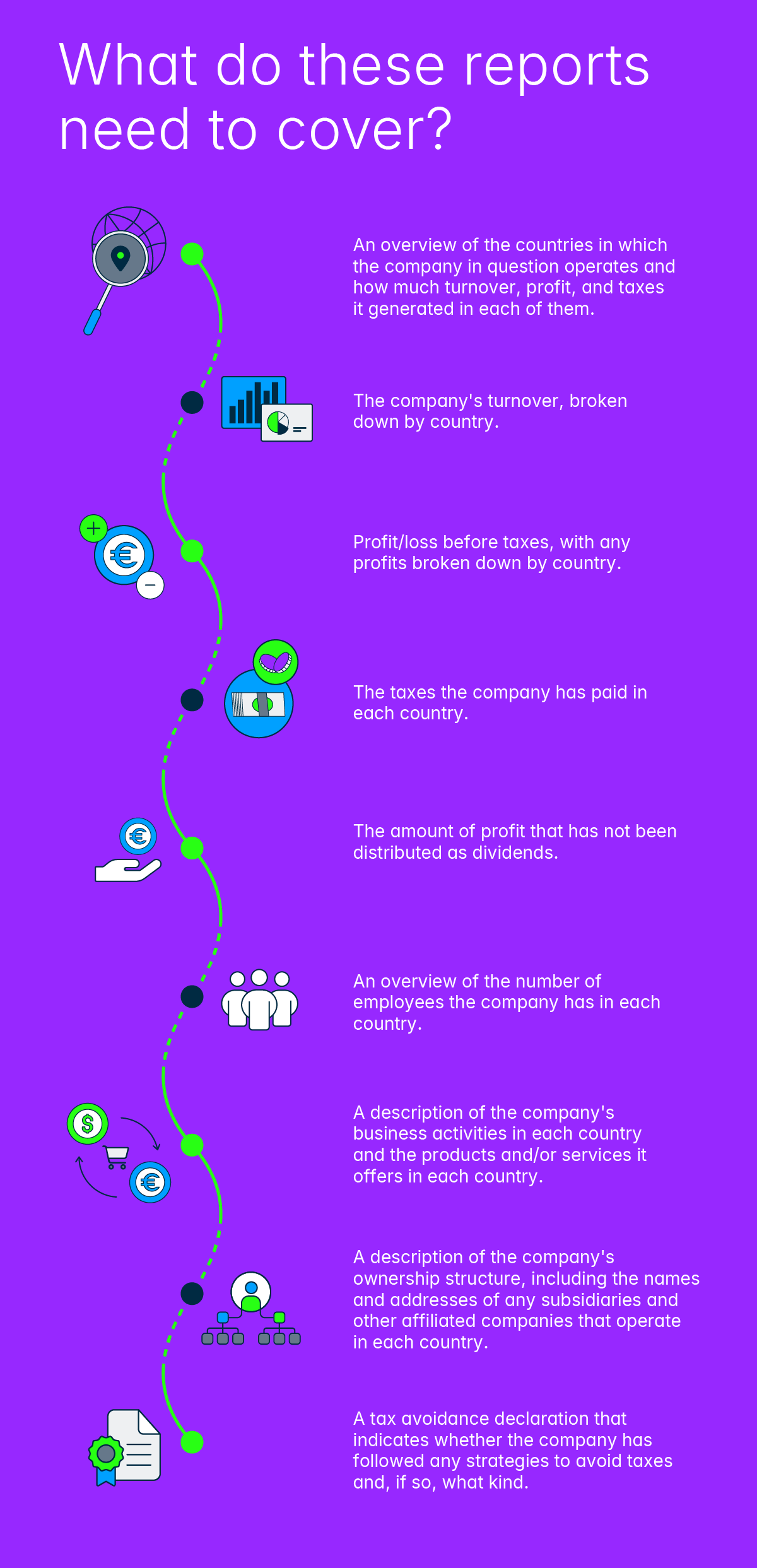

The EU passed the Public Country-by-Country Reporting (pCbCR) Directive back in 2021. An important part of the global effort to combat tax evasion and fraud, this reporting is designed to require greater fiscal transparency from high-revenue multinational enterprises. In publicly accessible reports, such firms will need to provide detailed information on their turnover, profits, taxes, and other financial aspects of their business activities in each country in which they operate.

These disclosure obligations are meant to promote an “informed public debate regarding, in particular, the level of tax compliance of certain multinational undertakings active in the Union and the impact of tax compliance on the real economy”. Referred to as “profit tax reports” (Ertragsteuerinformationsberichte) in the German-speaking countries and as “pCbCR” more generally throughout the EU, this requirement is to be implemented in all member states. This article illustrates how this will take place using Germany as an example. The reporting obligations and the time frame in which they will take effect may differ in some countries. Romania, for instance, implemented them in September 2022. Germany established these requirements in national law on June 21, 2023.

The new reporting requirements have been implemented in a new subsection of the German Commercial Code (HGB):

- Personal scope and definitions (§§ 342 and 342a HGB),

- Obligations regarding report creation (§§ 342b to 342f, HGB) and disclosure (§ 342m and § 342nHGB)

- Requirements regarding form and content (§§ 342g to 342l, HGB)

- Regulations regarding sanctions (§§ 342o and 342p, HGB)

Companies are already required to submit information to the fiscal authorities (“non-public CbCR”) in accordance with § 138a of the Fiscal Code of Germany (AO), and the new reporting obligations extend this requirement to the public. Since it believes that the new obligations could build on the existing requirement and estimates that only around 600 companies in Germany would be affected, the German Federal Ministry of Justice is seeking to implement public country-by-country reporting with minimal bureaucratic complexity. The German government assumes that the obligation to provide the public with transparent information about their tax affairs will encourage companies to regulate themselves. In other words, the belief is that enterprises will renounce tax havens and the like when forced to report on such activities. Companies are typically keen to let their good deeds shine, after all, and the government is hoping that the other side of that coin will also prove true – namely that no one wants to be seen engaging in fiscal practices that could be considered morally questionable. A review of the new reporting obligation and, if necessary, an extension of the scope of application or the content of the report should be carried out by June 2027.

Who is subject to country-by-country reporting?

In principle, the following types of consolidated enterprises (limited companies and limited-liability partnerships) are required to compile public country-by-country reports:

- Multinational companies based in Germany that are affiliated with a corporation (or are the top-most parent company of a corporation) and generate more than €750 million in consolidated turnover in each of two consecutive fiscal years

- Midsize or large subsidiaries or branch locations in Germany that belong to corporation-affiliated companies or top-most parent companies based outside of the EER (such as in the UK), with comparable revenues. These subsidiaries or branch locations are to obtain their reports from the top-most parent company in their corporation and publish them locally. If a subsidiary or branch location is unable to do so, it must compile its report itself.

Credit institutions subject to the Capital Requirements Regulation (CRR) and major securities firms are exempt from public country-by-country reporting if they publish a country-specific report in line with the relevant oversight requirements.