Ask decision-makers what they want from their finance function, and you’ll get a simple answer, “we want insights to help us make better decisions”. What’s the challenge? Most of the time the finance function is not able to generate them fast and reliable enough to be considered when the decision is made.

This is true regardless of if we consider insights derived from internal or external reporting. To decrease the time to insights we face several challenges. In this blog post we will focus on the challenges faced in the financial consolidation process.

The good news is that the financial consolidation process is not dependent on internal management allocations. The bad news is that numbers need to be accurate as they are used for external reporting to the market but also reporting to the executive management team and the board. How can the finance function address this challenge?

Manual processes and diverse data sources

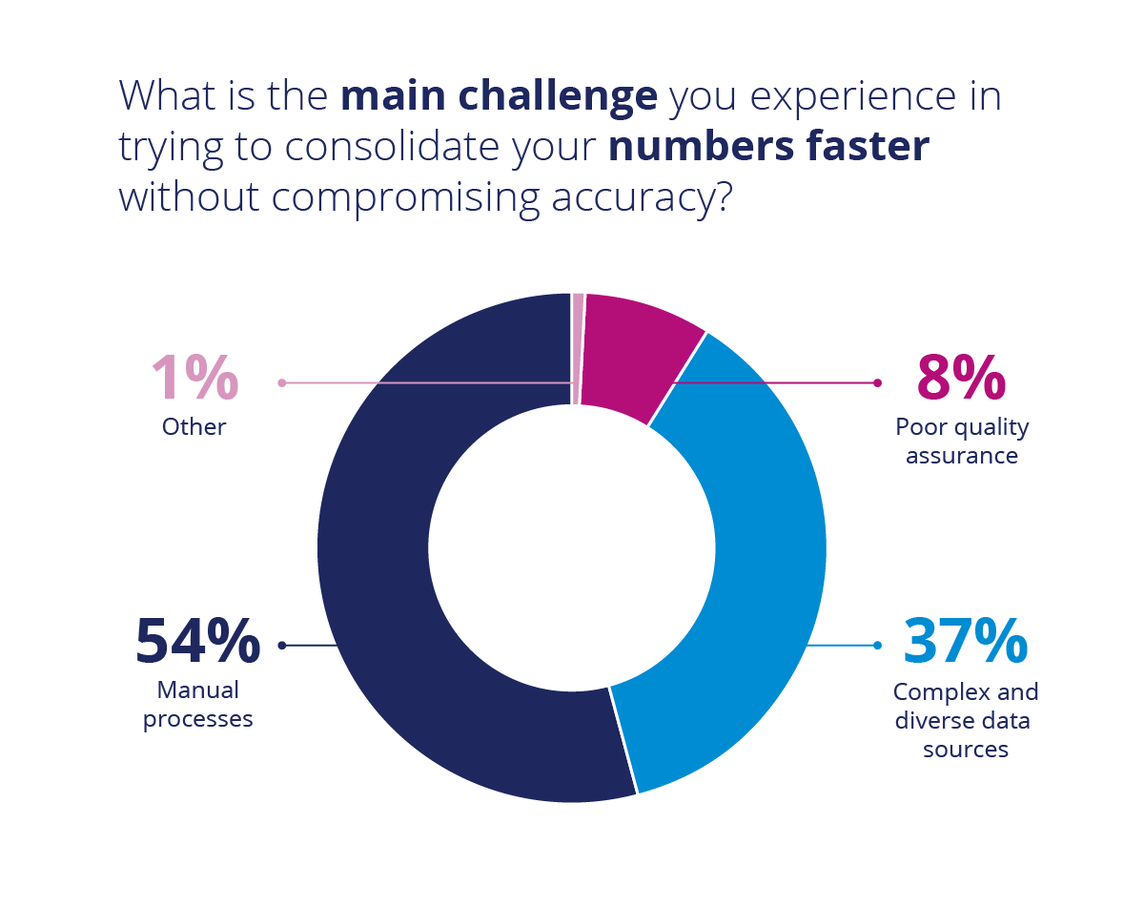

To better understand the challenge, we conducted a poll among finance and accounting professionals on LinkedIn. We specifically asked, “What is the main challenge you experience in trying to consolidate your numbers faster without compromising accuracy? We gave the following options:

- Complex and diverse data sources

- Manual processes

- Poor quality assurance

- Other

You can find the results of the poll below. More than 200 people voted and “Manual processes” was the clear winner with 54% of the votes while “Complex and diverse data sources” with 37% also figures to cause significant challenges. Only 8% noted “Poor quality assurance” as an issue.