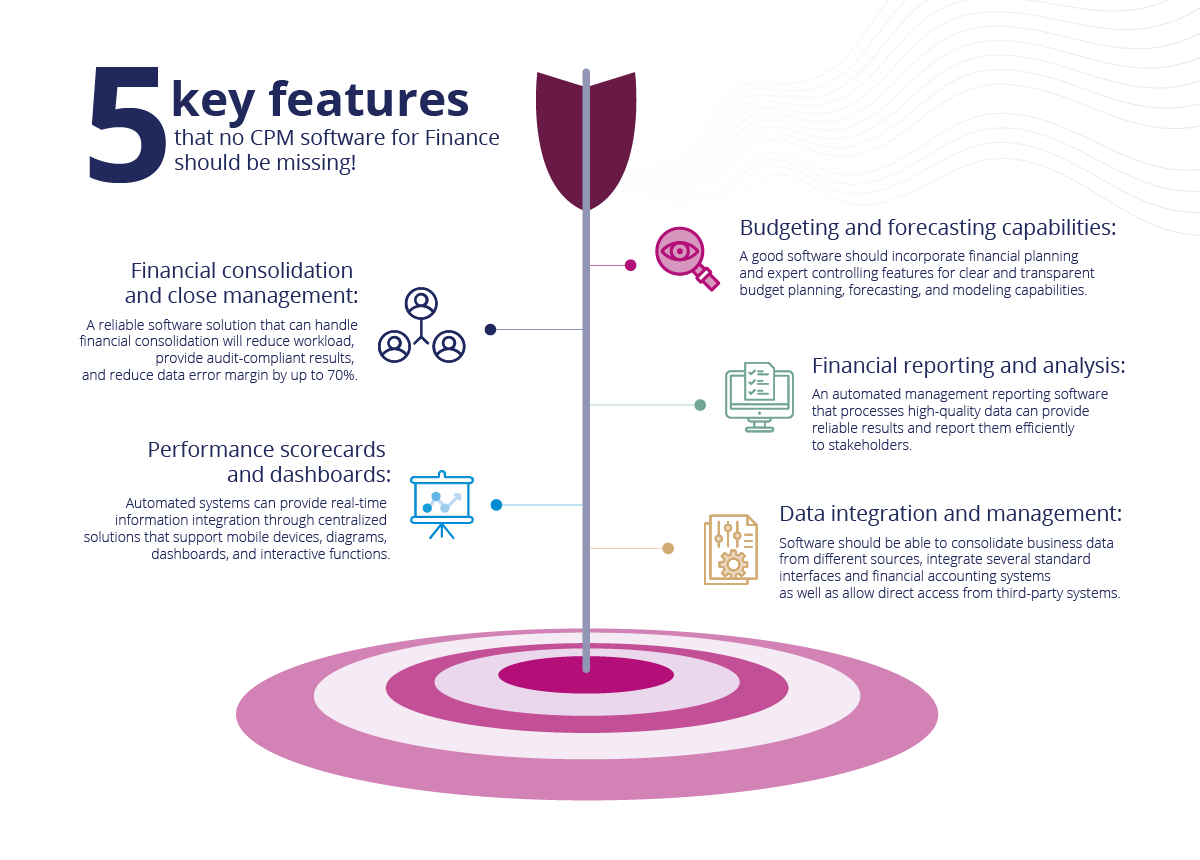

Companies of a certain size require a powerful CPM software to make their financial management easier, quicker, and more reliable – no matter which industry they work in. However, the core of a good CPM for Finance solution requires certain key features and functions that you should not neglect when choosing a particular product, even if your current company size or work area doesn’t need all of them yet. Sooner or later, every business benefits from a holistic approach that fulfills future requirements and basic functions from the beginning.

Budgeting and Forecasting capabilities

Good CPM software specialized in Finance should go beyond a few select industries. It should cover every aspect of your planning requirements, including budgeting and forecasting capabilities. The traditional approach of planning everything on Excel sheets and database solutions that are oftentimes not compatible with other standards cannot keep up with modern CPM software solutions that use integrated financial planning and professional controlling for completely transparent budget planning. Making the right decisions in budget planning also requires powerful forecasting capabilities and modeling functions that should be integrated with the same budgeting tool. The advantage of a holistic, user-friendly solution is, as always, a simplified approach with only one software that covers it all. A good CPM tool should include a direct connection to your source systems as well as automation of your most complex processes. Such a solution delivers reliable forecasts for your scenario planning that help you make informed decisions and stay ahead of any storm.

Financial Consolidation and Close Management

Financial consolidation is one of the most important features and top priority for the majority of companies. However, handling financial consolidation is time-consuming and often contains too many errors. If you have used Excel or other comparable solutions for your financial consolidation tasks, you know what this means. A reliable software that can handle financial consolidation and automates most financial statement preparations can be a game changer for your company. You will reduce your workload, understand every step of the financial consolidation, and get audit-compliant results, designed specifically to your individual needs. Using professional CPM software for financial consolidation and close management can reduce your data error margin by up to 70% and provides completely traceable data. If you use a holistic software solution, completing financial statements will be much faster than you can imagine.

Financial Reporting and Analysis

Evaluations and analyses of financial processes are very important for any successful business. But how do you get reliable results and report them? The answer is simple – by using an automated management reporting software that processes high-quality data. A good software solution will provide you with all the information and assistance you need to make your evaluation processes quick and reliable, just like any concluding analysis. You will often want to report to other stakeholders such as investors or customers. Deadlines and different requirements can make preparing financial reports and analyses without a proper software solution a painstakingly slow process. Instead, the right software will do this for you and prepare all relevant indicators you and your stakeholders require.