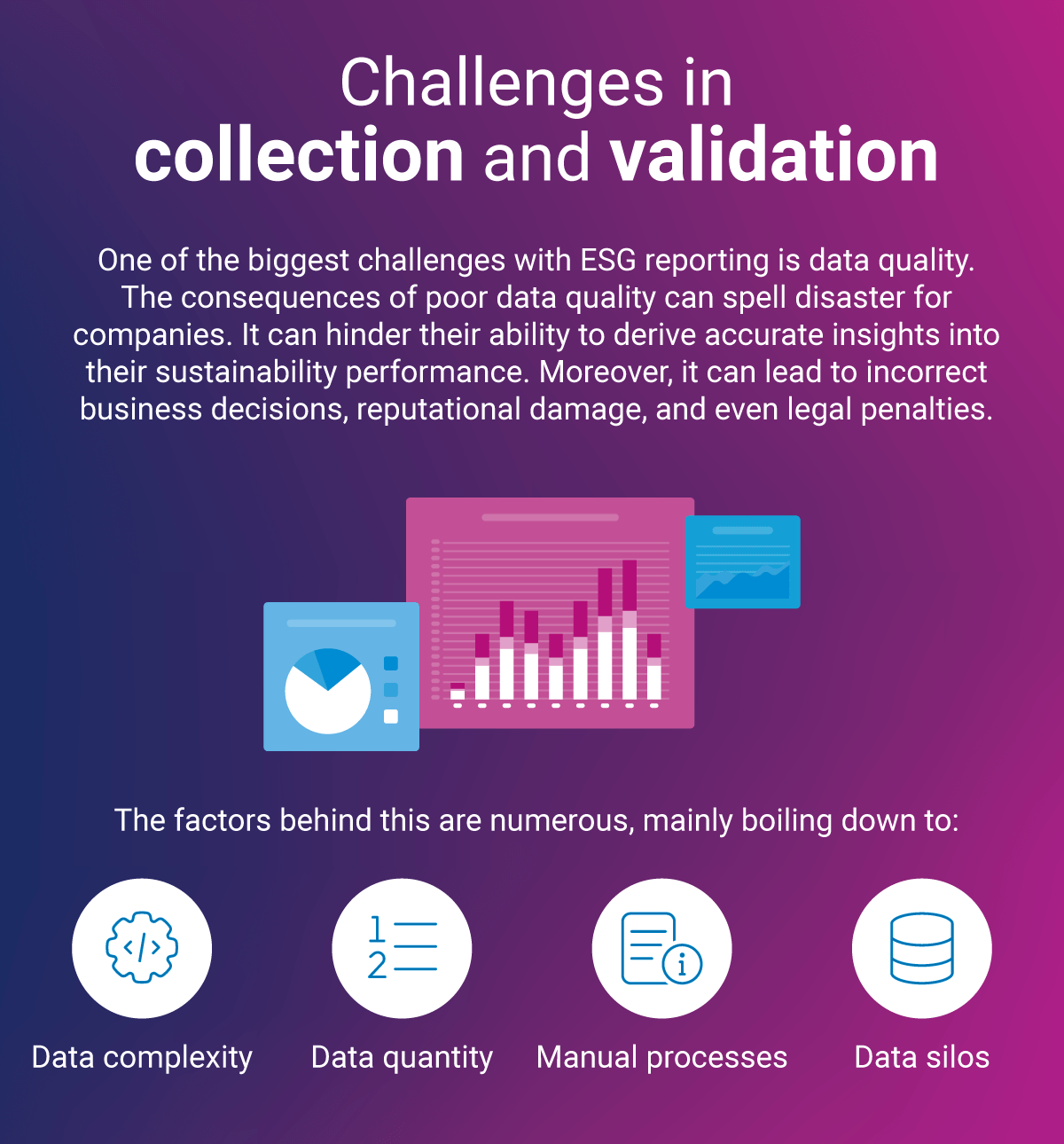

Data complexity

Data complexity is one of the major hurdles in collecting and validating ESG data. Each ESG factor has its own unique set of data requirements, making the data collection process complex and time-consuming. Additionally, the lack of standardized reporting frameworks and metrics further complicates the process, as organizations must navigate through a multitude of reporting standards and guidelines.

Data quantity

Another significant challenge is the sheer volume of data that needs to be collected. Organizations are expected to provide comprehensive and detailed information on their ESG performance, which requires collecting large volumes of data. This can be particularly challenging for organizations with complex business operations or global footprints, as they need to gather data from multiple subsidiaries or locations. Ensuring the accuracy and reliability of such a vast amount of data can be a daunting task, requiring robust data management systems and processes.

Data silos

Apart from the complexity and volume of ESG data, another challenge is the prevalence of data silos. Data silos are essentially insular reporting structures that are not conveniently accessible, often occurring due to lack of communication, organizational growth and legacy IT systems. A prime example of data silos can be seen in the use of spreadsheets. Many organizations have important financial and organizational data spread across multiple spreadsheets, making it difficult to obtain a comprehensive view of the entire organization and hampering the aggregation of this data. This is especially true in the case of ESG data due to the sheer scope of data that needs collecting, meaning finance teams often resort to having to aggregate data from a number of disparate data sources.

Manual Processes

Another issue is the overreliance on manual processes, which further complicates matters. Many organizations still rely on manual methods for data collection and validation, which are time-consuming, error-prone, and fundamentally not scalable for growing companies. The problems caused by manual processes go hand-in-hand with those caused by data silos, both causing significant roadblocks for finance teams attempting to accurately assess and report on ESG factors.

Conquering ESG data collection and validation challenges

Ultimately, the sustainability reporting landscape presents modern finance teams with enormous challenges, however these can be overcome with the right technology. Purpose-built software solutions can help organizations navigate the complexity and quantity of ESG data by providing a centralized platform to manage and analyze data. By aggregating data from various sources into a single source of truth, organizations can also eliminate data silos and ensure consistency and accuracy in reporting. Furthermore, by introducing automation ESG software can eliminate the risk of human error and save valuable time.

There’s no doubt that as the importance of ESG grows, so too will its complexity. By rising to the challenge with purpose-built software, organizations can not only meet the demands of ESG reporting but also unlock the potential for sustainable growth and positive impact.

Not sure where to start with procuring an ESG software solution to streamline your sustainability reporting? Check out our Buyer’s Guide

Need more information on ESG reporting?

Here’s all you need to know