The challenges of the EU taxonomy

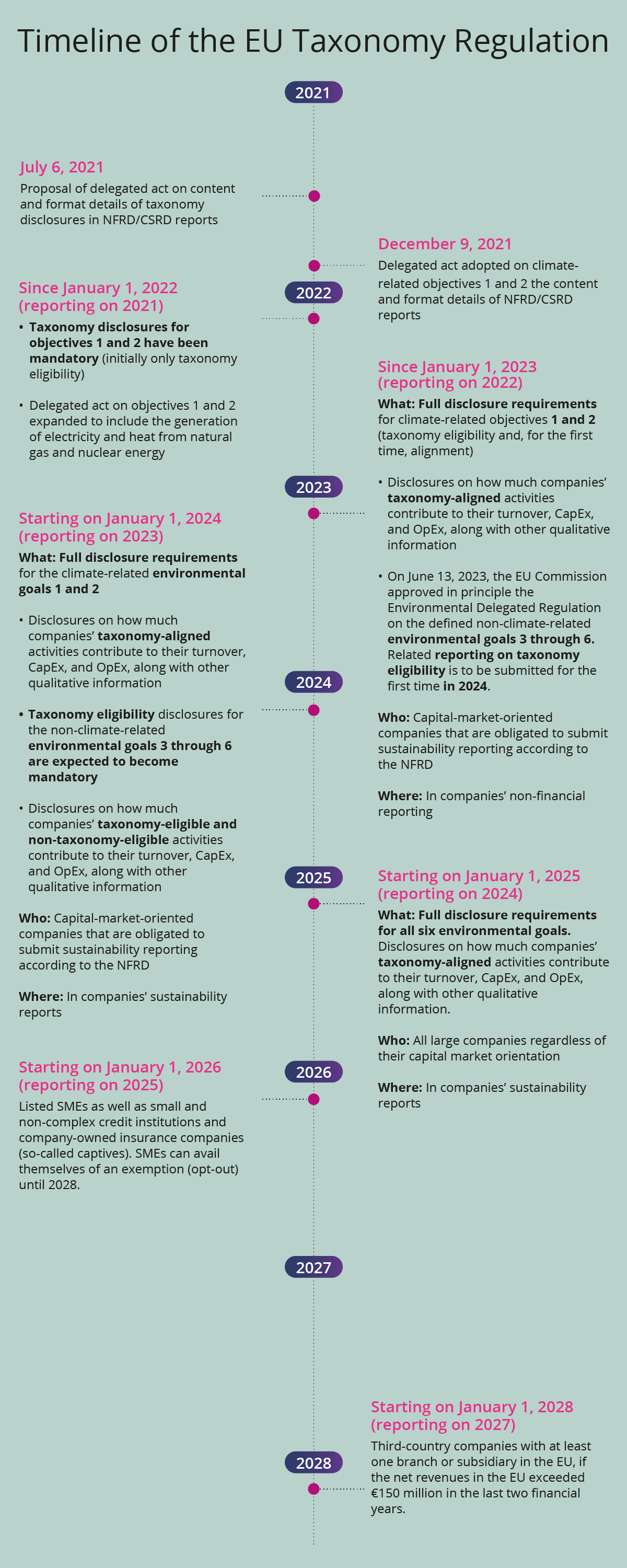

Finding a practical solution for a new concept: The EU taxonomy is a new concept for many companies. They need to familiarize themselves with the new requirements, especially those pertaining to the technical assessment criteria. The lack of corresponding best practices and workable processes makes meeting these obligations for the first time a formidable task.

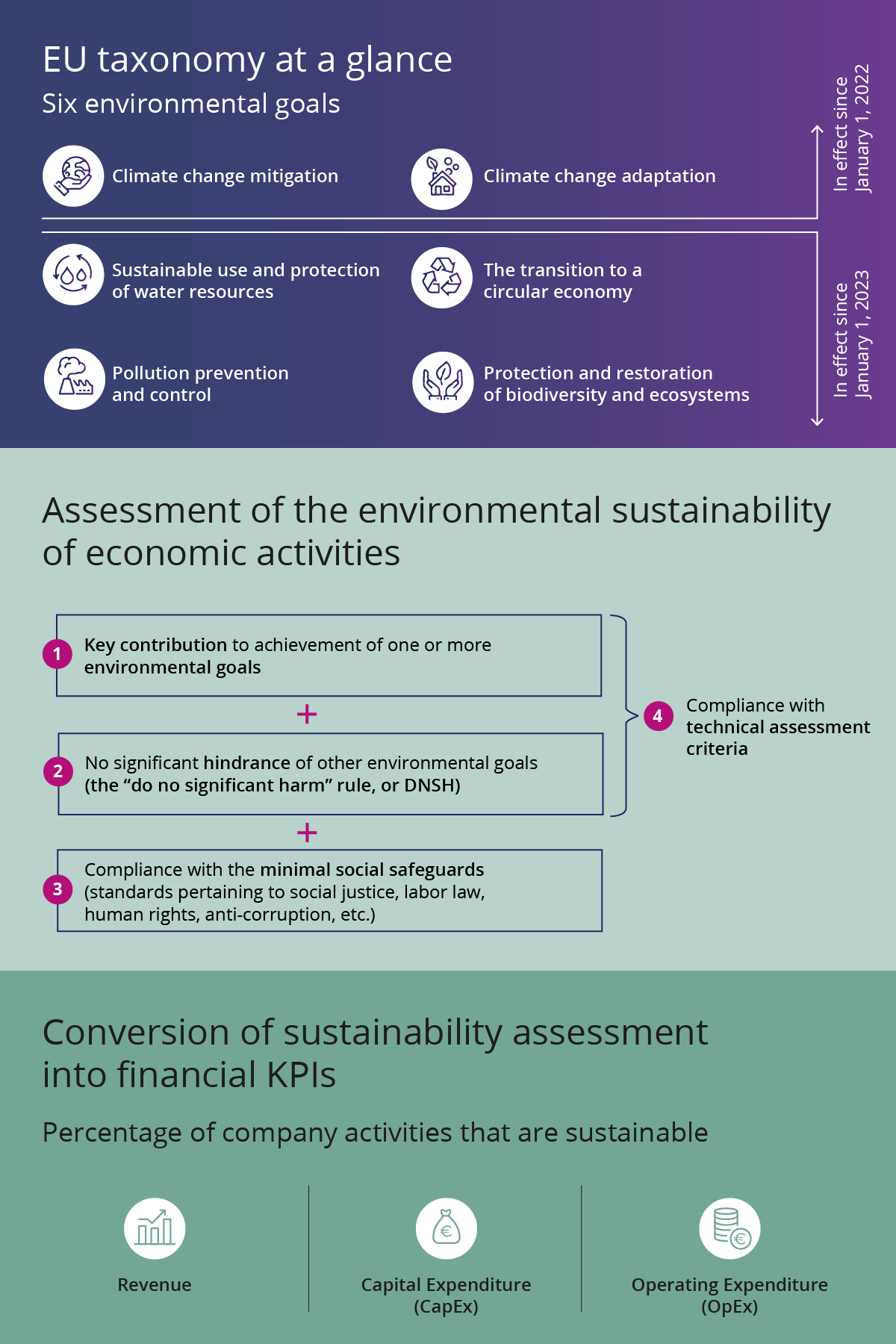

Integrated reporting: In the context of the integrated reporting concept (read: the combination of financial and non-financial KPIs), documenting the relevant criteria – significant contributions to climate-related environmental goals, DNSH, and compliance with minimum social standards, which are partially quantitative in nature – presents a particular obstacle. How can the required data be collected, and do you need to adapt your existing IT infrastructure?

Coordination and cooperation: Who is responsible for EU taxonomy compliance and the collection of corresponding information at your company? Examining all the criteria and making the necessary connections among different company areas for taxonomy reporting purposes entails a great deal of administrative effort, especially at larger companies that engage in numerous activities. To properly prepare the relevant KPIs, controlling specialists, sustainability departments and representatives, and other specialized areas and their experts need to work together in a coordinated manner.

Checklist: What are some specific steps you can take?

- Start getting familiar with the taxonomy concept at an early stage.

- Figure out who will be responsible for complying with the EU taxonomy and following related legislative developments at your company and make sure the various specialized areas and experts are appropriately interconnected.

- Reviewing taxonomy eligibility:

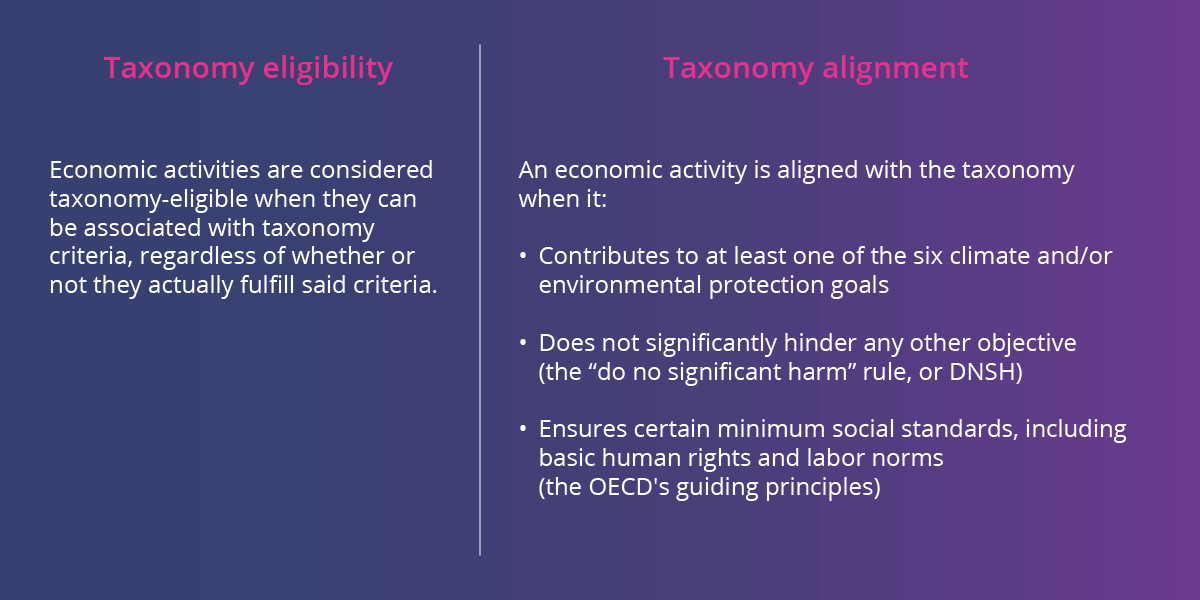

- Identify economic activities that are taxonomy-eligible (using the NACE codes for orientation) regardless of whether they are taxonomy-aligned.

- Confirm whether your taxonomy-eligible activities fulfill the relevant criteria for a significant contribution to at least one environmental goal (that is, whether they are taxonomy-aligned activities).

- Check whether these activities comply with the “do no significant harm” (DNSH) rule, meaning they do not significantly hinder the achievement of the other environmental goals.

- As part of a due diligence review, make sure your company's activities correspond to the minimum social standards defined in the EU taxonomy, including with regard to basic human rights and labor norms (the OECD's guiding principles).

A given economic activity can only be classified as taxonomy-aligned after passing each of the steps listed above.

- Calculate how much your company's taxonomy-aligned activities contribute to its turnover, capital expenditure, and operating expenditure and create corresponding reports.

- Check at an early stage whether the required data can be gathered and reported in accordance with the taxonomy using your current systems.

What needs to be reported? An overview of the EU taxonomy KPIs

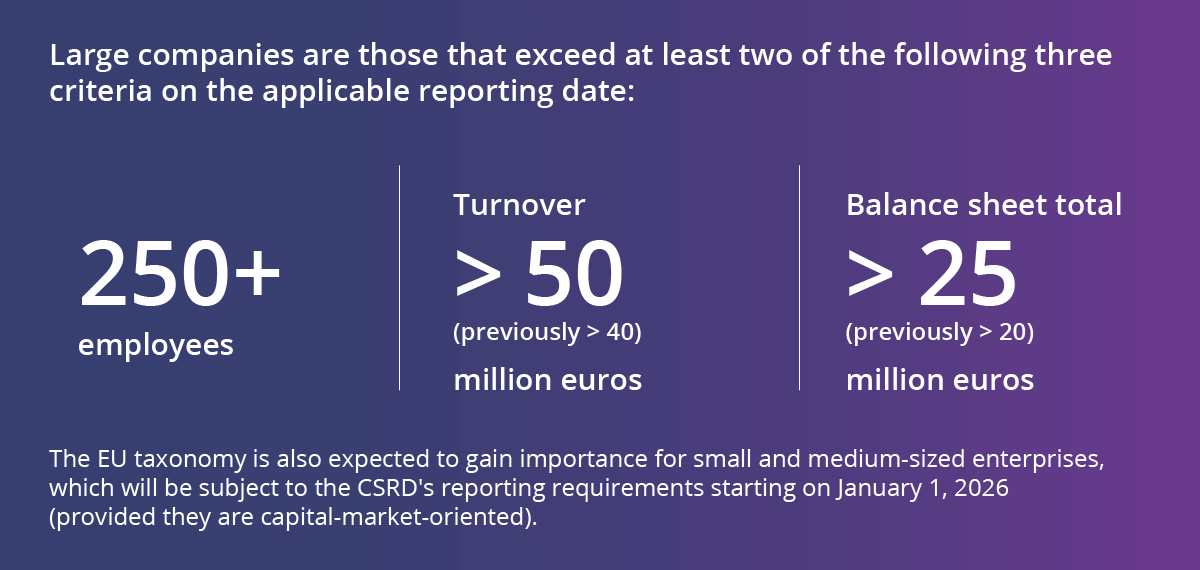

The EU taxonomy differentiates between financial companies (fund managers, credit institutions, securities firms, and insurance companies) and non-financial companies (those in the real economy).

Starting in 2024, credit institutions will need to publish the percentage of their financing activities that pertain to taxonomy-aligned endeavors in relation to their overall assets. Additional KPIs will then be subject to disclosure as of 2026. According to the EU Taxonomy Regulation, companies in the real economy are already required to report KPIs on their turnover, CapEx, and OpEx.

The turnover KPI

As specified in Art. 8, para. 2a of the EU Taxonomy Regulation (2020/582), the proportion of turnover is to be calculated as the percentage of a company's net turnover that is associated with economic activities that qualify as economically sustainable in relation to the company’s net turnover within the meaning of Art. 2, item 5 of Directive 2013/34/EU. Turnover includes earnings as defined by International Accounting Standard (IAS) 1, para. 82(a) in the version pertaining to EC Regulation No. 1126/2008.

The CapEx KPI

This KPI expresses a company's capital expenditure on taxonomy-aligned economic activities in relation to its total capital expenditure (Art. 8, para. 2b of the EU Taxonomy Regulation).

Calculating the CapEx KPI

Numerator

Proportion of the capital expenditure contained in the numerator:

- For assets or processes derived from taxonomy-aligned economic activities

- For the planned expansion of taxonomy-aligned economic activities or the transformation of taxonomy-eligible activities into taxonomy-aligned activities (CapEx plan)

- For the acquisition of services derived from taxonomy-aligned economic activities and individual measures through which decarbonization or reduced greenhouse gas emissions can be achieved within the next 18 months

Denominator

All capital expenditure on acquiring tangible and non-material assets

Source: German chamber of accountants and auditors

The OpEx KPI

This KPI refers to the operating expenditure a company spends in connection with taxonomy-aligned assets or processes in relation to its overall operating expenditure (see Art. 8, para. 2b of the EU Taxonomy Regulation).

Calculating the OpEx KPI

Numerator

Proportion of the operating expenditure contained in the numerator:

- For assets or processes derived from taxonomy-aligned economic activities, including training costs and non-capitalized research and development expenses

- That can be attributed to a CapEx plan

- For the acquisition of services derived from taxonomy-aligned economic activities and individual measures through which decarbonization or reduced greenhouse gas emissions can be achieved within the subsequent 18 months (this includes expenses related to building renovations)

Denominator

All direct operating expenditure on:

- Research and development

- Building renovations

- Short-term leasing

- Maintenance and repairs

- Ongoing maintenance of tangible assets by the company in question or third parties

Source: German chamber of accountants and auditors

What benefits does the EU taxonomy offer to your company?

The EU taxonomy isn’t just something you’ll need to commit significant resources to; it has a number of positive aspects, as well. Around the world, many countries are already developing their own national taxonomies alongside the EU. Companies that focus on sustainability early on will enjoy competitive advantages in numerous markets. Improved transparency in related reporting will also benefit firms that want to raise their profiles through their sustainable activities. At the same time, the provision of better information to investors interested in sustainability will make it easier for corresponding companies to acquire fresh capital.

The leading role the EU taxonomy is playing around the world

The EU taxonomy is the first legally binding (and thus the most progressive) standard of environmentally friendly investment. The EU's rules on classifying economic activities are thus providing orientation to many countries across the globe as they develop their own national taxonomies. While non-EU countries are not required to comply with the EU's specifications, parent companies based in the European Union must fulfill the requirements of the EU taxonomy on behalf of their entire group – that means for subsidiaries based outside of the EU, as well. The disclosure obligations within the EU are therefore also impacting the operations of international market participants and firms’ sustainable activities in non-EU countries.

Along with the EU and China, around 20 countries and regions have taken steps toward implementing green, social, or transition taxonomies in recent years, or are currently in the process of doing so.

Tackling the EU taxonomy's reporting requirements

Identifying taxonomy-eligible economic activities, determining the extent to which they correspond to the technical assessment criteria, measuring their financial contributions, and calculating the corresponding KPIs are complex undertakings that shouldn’t be taken lightly. That applies to the requirements related to the layout and format of reports, as well. The huge amounts of data, the central management thereof, and above all, the high standard of data quality involved pose serious challenges. The best way to take them on is with an intelligent ESG reporting tool. From EU taxonomy mapping to KPI calculation and eventual reporting, you can generate your consolidated annual reports (and sustainability reports) in a fast, dependable, and automated way and submit them in the iXBRL format required by law at the click of a mouse. Sound too good to be true? Lucanet makes it possible! Do you have further questions on this subject? Feel free to contact us at your convenience.

Contact us