In both the political discourse and society in general, the subject of sustainability has already been gaining importance for several years. Reporting related to environmental, social, and governance (ESG) aspects is playing a central role in companies and their business models, as well. This is why the EU Commission has set its sights on becoming a pioneer in the provision of meaningful, high-quality sustainability information.

Back on April 21, 2021, it published a draft directive containing its proposals for the further development of sustainability reporting. After some contentious debate, a political compromise regarding the new Corporate Sustainability Reporting Directive (CSRD) was reached on June 21, 2022 during the trilogue negotiations involving the EU Commission, the European Parliament, and the European Council. The European Parliament and European Council then officially agreed to the compromise on November 10 and November 28, respectively.

CSRD set to replace previous CSR directive

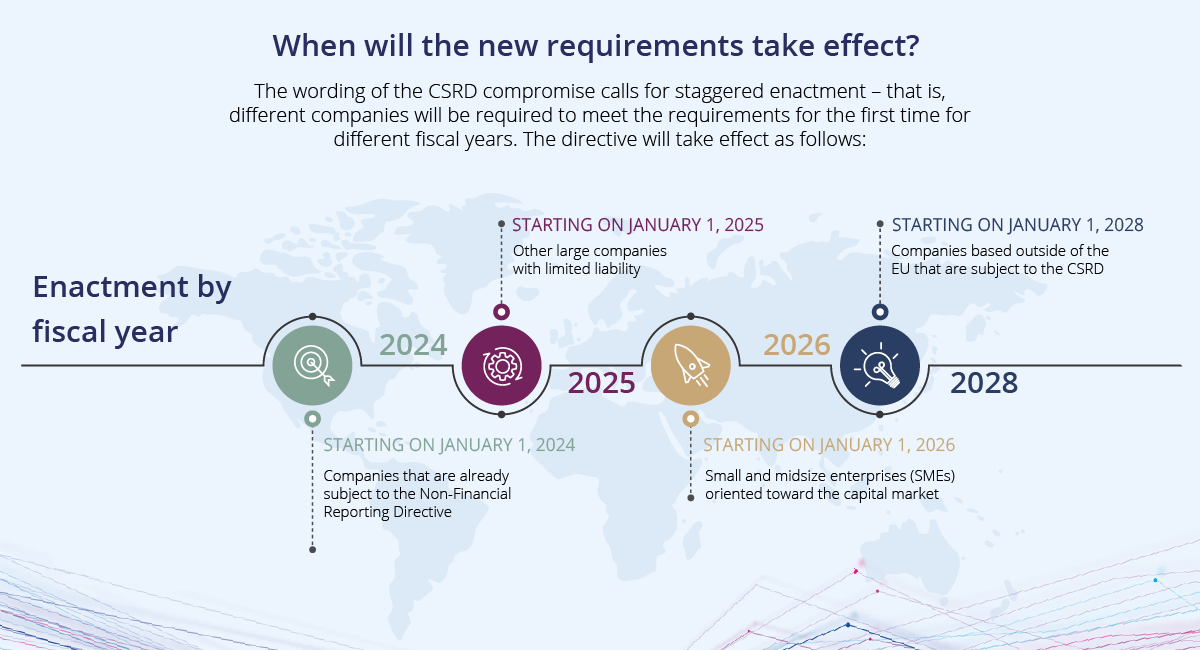

The final draft of Directive (EU) 2022/2464 on sustainability reporting (in short, the CSRD) was published in the Official Journal of the European Union on December 16, 2022. It then took effect on January 5, 2023. In addition to replacing the previous CSR directive (2014/95/EU), the CSRD entails changes in the subject matter of other legislation, particularly Directive 2013/34/EU (on financial statements and related reports). The EU’s member states (including Germany) must now transpose the new directive into their national laws by July 2024 at the latest.

To whom does the CSRD apply?

The CSRD represents a huge expansion of the range of entities that will be required to submit sustainability reports. According to Article 19a, para. 1 of the revised directive on financial statements, sustainability reporting duties now apply to the following companies:

- All large companies with limited liability (i.e. listed companies and limited-liability partnerships) in the EU

- All large insurance companies and credit institutions in the EU (regardless of their legal form)

- All capital-market-oriented companies in the EU, including small and medium-sized companies (but not micro-enterprises)

- Companies based outside of the EU that have generated more than €150 million in annual net turnover in the EU in each of the past two fiscal years and have a) at least one large or capital-market-oriented subsidiary in the EU or b) a branch in the EU that generated more than €40 million in net turnover in the most recent fiscal year

- Companies based outside of the EU to which the CSRD applies and whose securities are approved for trade in a regulated EU market

“Large companies” are those that meet at least two of the following size criteria on two consecutive closing dates:

- Balance sheet total of at least €20 million

- At least €40 million in turnover in the 12 months prior to a given closing date

- Annual average of at least 250 employees

Adjustments will apply analogously to reporting at the group level, although certain exemptions will be possible (especially in the context of parent companies and subsidiaries).

Who is exempt from these reporting requirements?

The CSRD offers subsidiaries the possibility of exemption from its sustainability reporting requirements. A subsidiary seeking exemption must meet the following prerequisites:

- It is included in the group management report of its parent company

- That group management report contains a group sustainability report that meets the CSRD’s specifications

- The subsidiary provides certain information in its own management report (such as the name and headquarters of its parent company, a link where its parent company's group management report can be accessed online, and an acknowledgment that it is claiming exemption)

Large companies in the public interest are not eligible for this exemption, however. In addition, any parent company compiling a group sustainability report that exempts a subsidiary must describe in this report any significant differences that exist between the sustainability-related risks or ramifications of its group and those of one or more of its subsidiaries.

Comparable exemption possibilities apply for subsidiaries of companies based outside of the EU.

To what extent does the CSRD affect small and medium-sized companies (SMEs)?

Initially, the requirements of the CSRD will only apply to capital-market-oriented SMEs. Such companies will be able to opt out of the new reporting duties for a two-year transitional period. If they do, however, they will need to indicate why they decided against submitting sustainability reporting in their management reports. The CSRD also specifies reduced requirements for SMEs in various areas of sustainability reporting.

That said, even SMEs that are not oriented toward the capital market are expected to be subject to implicit reporting duties due to the tangential effects of the CSRD's disclosure requirements regarding value chains and supply chains. This is because companies that need to submit sustainability reports will have to request some of the necessary data from suppliers and other entities that are themselves not actually subject to the same requirements.