eBook

Pillar 2 presents multinational companies with a daunting task. Discover solutions for efficient and accurate Pillar 2 calculation in this eBook.

Trusted by industry-leading brands

Multinational businesses must coordinate tax filings across jurisdictions while ensuring compliance with CBCR.

Tax authorities demand structured, traceable records to prove compliance and prevent penalties.

Companies must track obligations, manage workflows, and enforce controls like milestone tracking.

Awards

A top-ranking platform

Lucanet by the numbers

of users confirm outstanding usability

customers confirm fast and easy implementation

working hours saved by increased productivity

Benefits

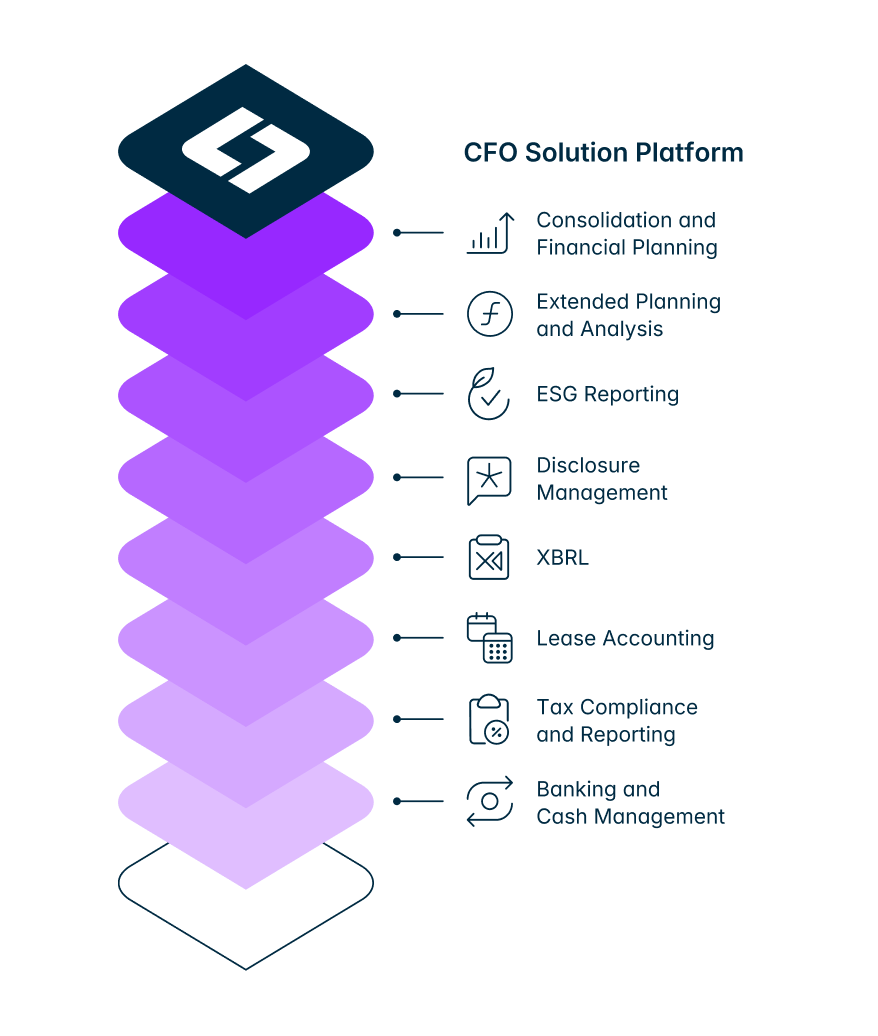

Gain more control of your tax management with an intelligent platform that handles your entire tax lifecycle. Simplify complex reporting, minimize risk, and empower your tax team with unmatched control - all in one seamless solution.

Unify tax, accounting, and finance data into a single source of truth to be better prepared for your tax close process and eliminate inefficiencies.

Generate master files, synchronize local disclosures, and ensure consistency while reducing review times and manual effort.

Securely automate, connect, and standardize data across entities and regions with comprehensive access controls and permissions.

Deliver accurate, transparent reports with granular tracking that records every data change, fostering trust across your organization.

Key features

Certifications

By using recognized industry standards, Lucanet ensures the protection of company, customer and partner information.

Related resources

eBook

Pillar 2 presents multinational companies with a daunting task. Discover solutions for efficient and accurate Pillar 2 calculation in this eBook.

Infographic

Download our infographic to discover the six biggest challenges that finance teams face with Pillar 2 compliance, and how to overcome them with strategic solutions.

Infographic

Discover if you're ready for Pillar 2 compliance with our comprehensive checklist and simplify your tax reporting processes.

Infographic

Get a clear overview of Pillar 2 regulatory guidelines and operational timelines.

On Demand Webinar

In this webinar, Lucanet and WTS experts will guide you through the practical next steps after reporting and before filing.