Trusted by industry-leading brands

Solutions

A comprehensive tax solution for all of your needs

-

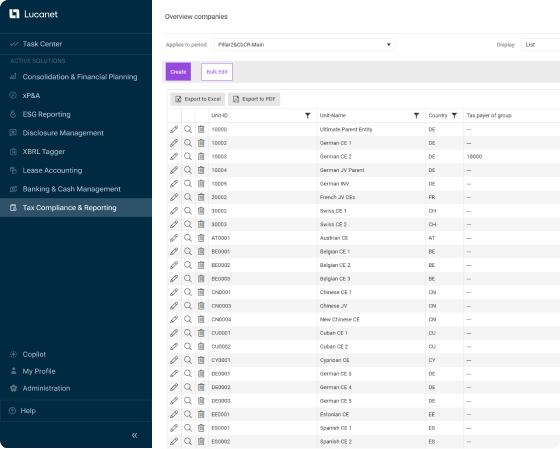

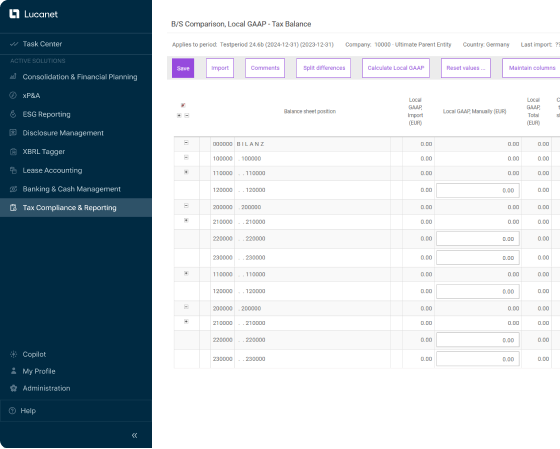

Tax Compliance and Reporting

-

Income Tax

-

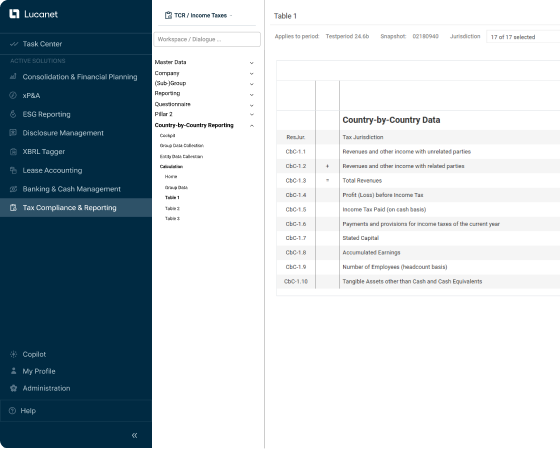

Country-by-Country-Reporting

-

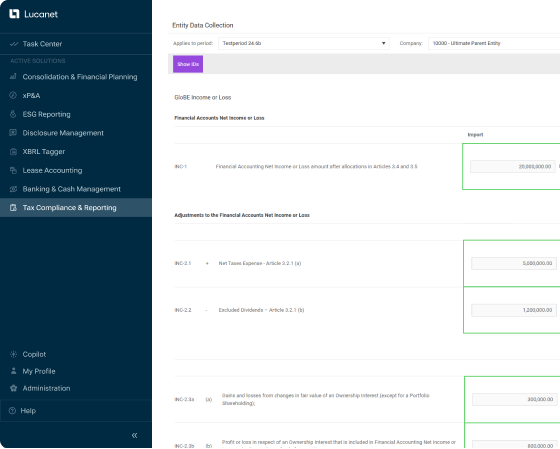

Pillar 2

-

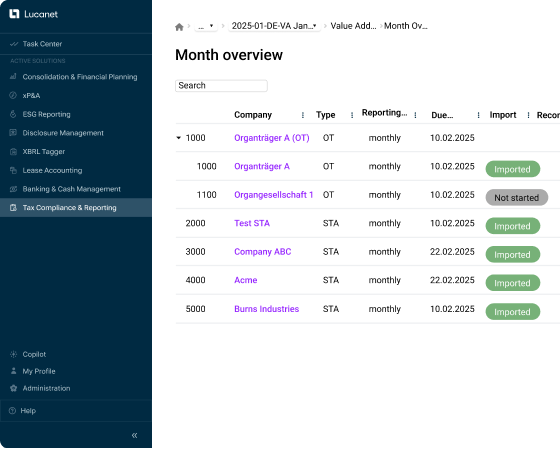

VAT Return